magazine 26 Jul 2018

Download PDF Page flip version

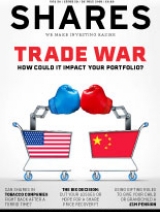

Heightened tensions regarding a trade war between the US and China pose a major threat to investors. Read about the potential impact on stock markets and the issues investors need to consider to protect their portfolios.

Also this week: Can tobacco stocks fight back after a torrid time? Shares looks at the importance of diversification when picking funds, plus there are articles on Lowland, Tesco, Melrose, Hammerson, McBride, Unilever, platinum prices, Japan and more.

Read a debate on problematic investments, namely whether to cut your losses or hope for a price recovery. And learn how to use gifting rules to give your child or grandchild a £1m pension.

We talk to numerous experts about the impact of tensions between the US and China on economics and global stock markets

A report is being compiled into whether companies are using buybacks to artificially inflate executive pay

We examine the thought process for dealing with investments that aren't going to plan

Online women’s fashion brand has delivered spectacular gains for shareholders

The retail property investor wants to offload a lot of properties... but will it get a good price?

The revolt at Royal Mail is the latest in a string of challenges against UK-listed firms

The groceries goliath is rumoured to be launching a new discount brand

Reports suggest chairman Philip Hampton is sounding out shareholders about a corporate break-up

The healthcare company is also aiming for at least 10% annual organic sales growth

Investment experts revive the debate about some income funds being too reliant on just a handful of sectors

Patchy economic conditions warrant some form of protection in case there are portfolio shocks

It is important to check fees and the suitability of your platform

We explain how to get the most out of inheritance tax allowance

There is an argument to suggest all the bad news in now priced into platinum miners’ shares

Japanese shares have outperformed since Abe became PM in 2012 but can that continue?

London’s listed tobacco titans are determined their high returns won’t be vaporised

Contrarians should pounce on the private label household goods-to-personal care products supplier

Analysts suggest you could make 30% share price gain in a year plus possible cash returns on top

Acquisitions and detailed results could be the next catalysts to fuel renewed re-rating

Dilution a price worth paying based on recent track record with acquisitions

Latest industry data would suggest Dalata could produce decent financial results

Earnings beat expectations and another €3bn worth of shares will be bought back