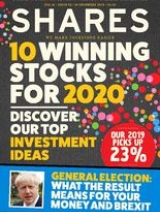

magazine 19 Dec 2019

Download PDF Page flip version

Discover Shares’ top stock picks for 2020. Don’t miss this bumper edition of the digital magazine, particularly as the team’s stock picks for 2019 smashed the market with a 23% total return.

Also this week: Bank of America forecasts that stocks will rally well into next year. Shares also looks at how UK stocks have performed following the general election result.

Discover the best performing funds and investment trusts of the year and enjoy four fund ideas for 2020.

Elsewhere, Shares offers money-boosting New Year’s resolution ideas, it explains the key themes in the small cap space and it reveals why Sports Direct is going upmarket.

Now rebranded as Frasers, its shares have shot up as an update shows signs of promise

The withdrawal agreement looks set to be concluded but uncertainty remains over trade talks

Investor sentiment continues to improve according to its latest report

We explain why the election result could be good news for leaders

The scale of the Conservative victory caught investors by surprise

Is it normal to see so many leadership changes among the largest companies on the UK stock market?

How shares in Russa, Brazil, China and India fared in 2019 and what’s in focus for 2020

Three things the Franklin Templeton Emerging Markets Equity team are thinking about today

Reports of its demise are premature as rising wage pressures show

We look at what’s been driving growth company shares in the last 12 months

What could happen to Pennon, Marks & Spencer, Micro Focus and more next year?

Seven ideas to make you smarter with money in 2020

It’s been a rewarding 12 months for investors, particularly as markets rally going into Christmas

We’ve had one of our best years in a long time with stellar share price gains

Luceco has the power to drive significant profit growth in 2020

We also reveal how last year’s fund selections delivered excellent returns

A generous dividend yield and an improved domestic picture means now is the time to buy this ‘boring’ bank

Kainos is capitalising on huge opportunities to help government departments and companies embrace 21st Century technology

Increasing insolvencies are a boon to specialist practitioner Begbies Traynor

The posh chocolates seller is a cash generative growth business with global aspirations

A refocus on cheaper tariffs is already starting to change customer switching habits

Wizz Air is growing fast and is the underappreciated star of the airline sector

Cashed up housebuilder Redrow should benefit from a revived housing market and offers generous dividends

Schroders is set to cash in on wealth management and US growth

It is growing with some of the world’s leading retailers and pays rising dividends

The industry looks to be a major turning point and not necessarily a good one for those involved

AJ Bell pensions expert Tom Selby explains how the system works