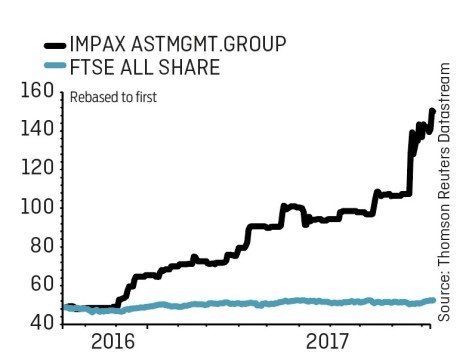

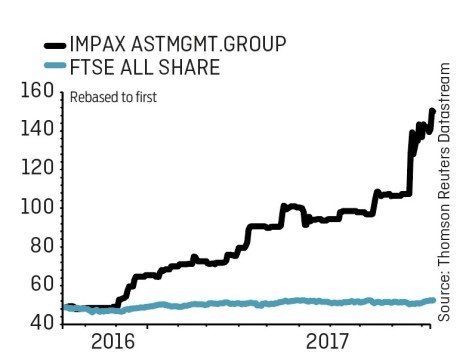

Impax Asset Management (IPX:AIM) 150.5p

Gain to date: 18.9%

Original entry point: Buy at 126.6p, 21 September

Our bullish stance on sustainable investment focused asset manager Impax Asset Management (IPX:AIM) is paying off. The company’s recent acquisition of US peer Pax World Management has clearly sparked renewed interest in Impax.

The deal, expected to close by February next year at the latest, will add an extra 42% of assets under management (AUM). This would bring the company’s AUM to £10.3bn, and potentially attract more institutional investors to the firm’s products.

Investor sentiment towards the asset manager is extremely positive at the moment despite tough regulations such as MiFID II coming in early next year. The company was already enjoying a successful 2017 even before the acquisition news broke.

Back in May, we flagged the company due to the large amount of inflows into its funds.

Stuart Duncan, analyst at Peel Hunt, notes this pattern is continuing as Impax took in £402m in net new money in the three months to 30 September.

Duncan has upgraded his 2017 pre-tax profit and earnings per share forecasts both by 6%, to £8.4m and 5.1p respectively.

Shares says: Keep buying the stock as the company is set to benefit from a greater US presence through its Pax deal.

‹ Previous2017-10-12Next ›

magazine

magazine