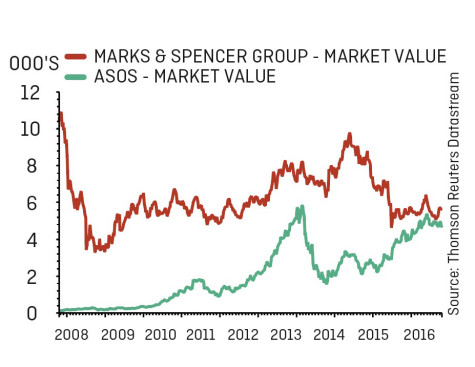

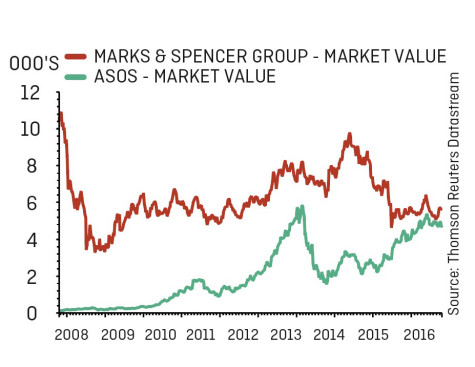

Online fashion retailer ASOS (ASC:AIM) is now worth nearly as much as Marks & Spencer (MKS) – an amazing feat considering the business has only existed for 17 years. The latter has been around since 1884.

ASOS is now worth £4.63bn versus Marks & Spencer at £5.64bn. Fifteen years ago ASOS was valued at a mere £4.6m.

Marks & Spencer may have wished it spent more money a decade ago on the internet. Its business is now struggling from a lacklustre clothing and home proposition and too much store space.

In contrast, ASOS is now an international business whose pre-tax profit jumped by 26% to £80m in the last financial year, with sales up by a third to £1.92bn. Overseas sales spoke for 63% of total retail sales, up from 57% last year.

Marks & Spencer is a more profitable business, nonetheless. Its last financial year saw £10.6bn revenue and £613.8m adjusted pre-tax profit.

Chief executive Steve Rowe is currently overseeing a plan for a ‘simpler business, focused on customers’. Investors are still waiting for evidence the plan is working, given the retailer’s shares have gone nowhere in the past 12 months. (JC)

‹ Previous2017-10-26Next ›

magazine

magazine