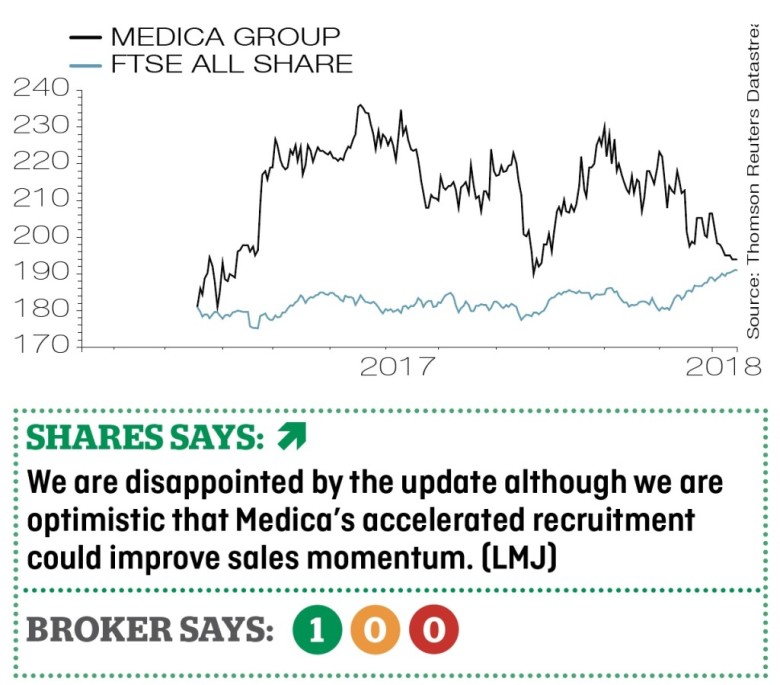

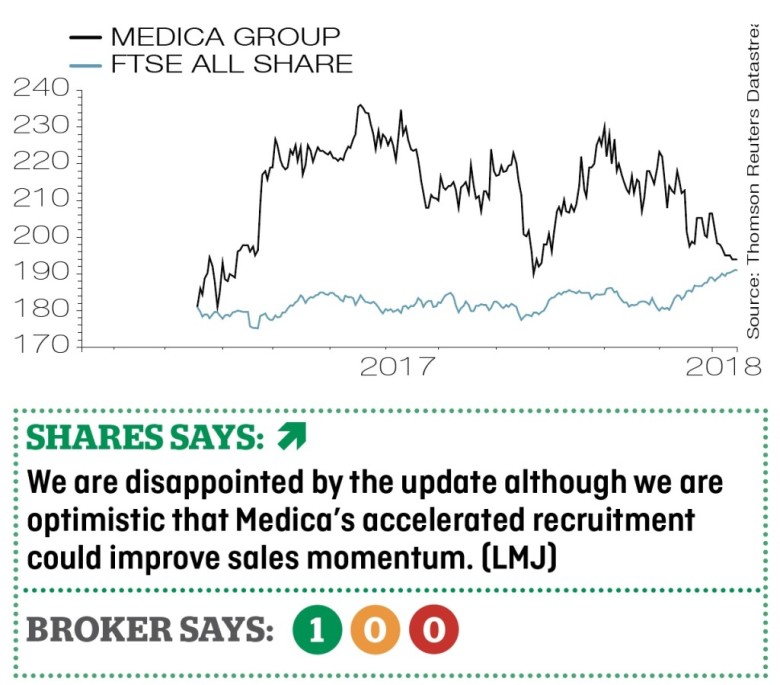

Medica (MGP) 166.8p

Loss to date: 20% (Stopped out)

Medica (MGP) has crashed out of our Great Ideas portfolio after a disappointing trading update. This triggered a 14% share price crash and sent the shares below our stop loss level of 175.4p.

Medica uses consultant radiologists to interpret computerised tomography (CT) and magnetic resonance imaging (MRI) scans to diagnose various diseases.

The share price was hit hard after Medica revealed its performance is expected be ‘slightly behind’ market expectations. The shares were vulnerable to bad news as they were on a premium valuation.

In September, Medica was trading at a forecast 29.8 times earnings per share (EPS) in the year to 31 December 2018.

Stockbroker Investec’s Cora McCallum says Medica missed its sales by forecasts by 5%, but believes this can be compensated by a stronger profit margin via short-term cost savings. McCallum has cut net income forecasts by up to 7%.

Based on revised forecasts the shares trade on 21 times EPS at 166.8p (16 Jan).

In November, we were confident slower sales growth was a temporary blip and expected a recovery.

While Medica hired six more radiologists than expected, capacity constraints limited sales momentum.

‹ Previous2018-01-18Next ›

magazine

magazine