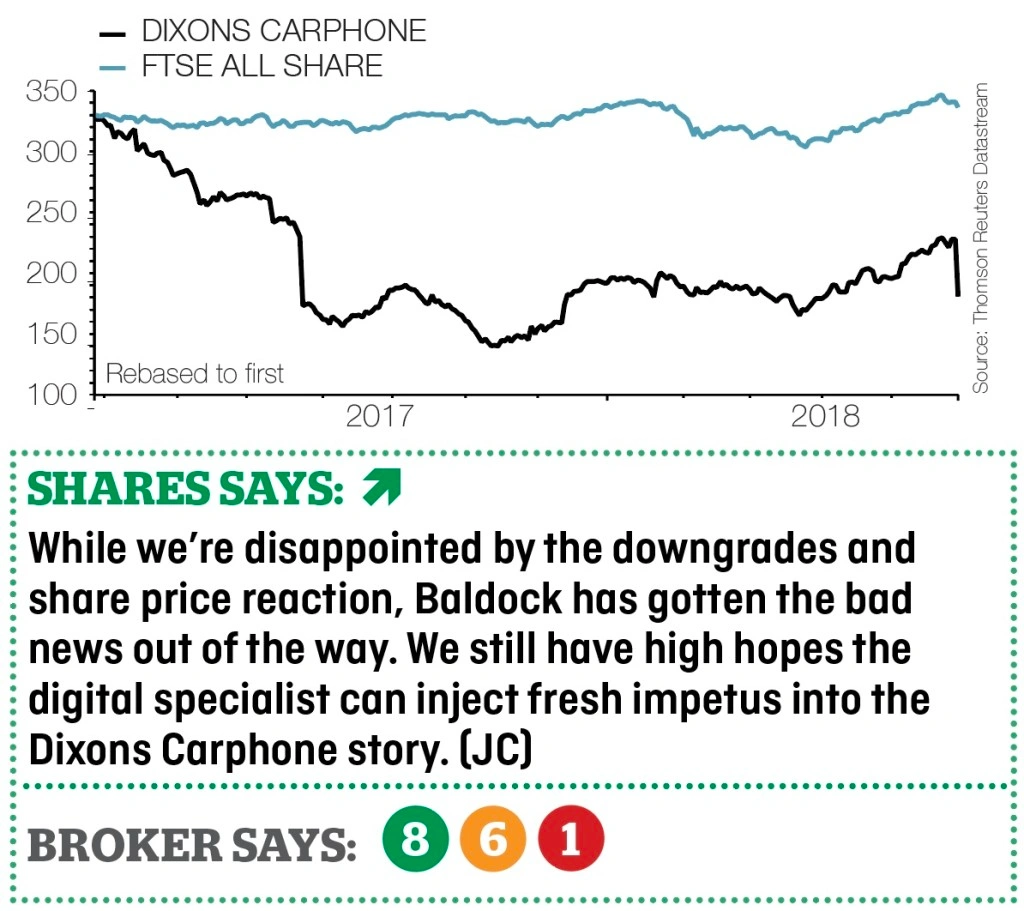

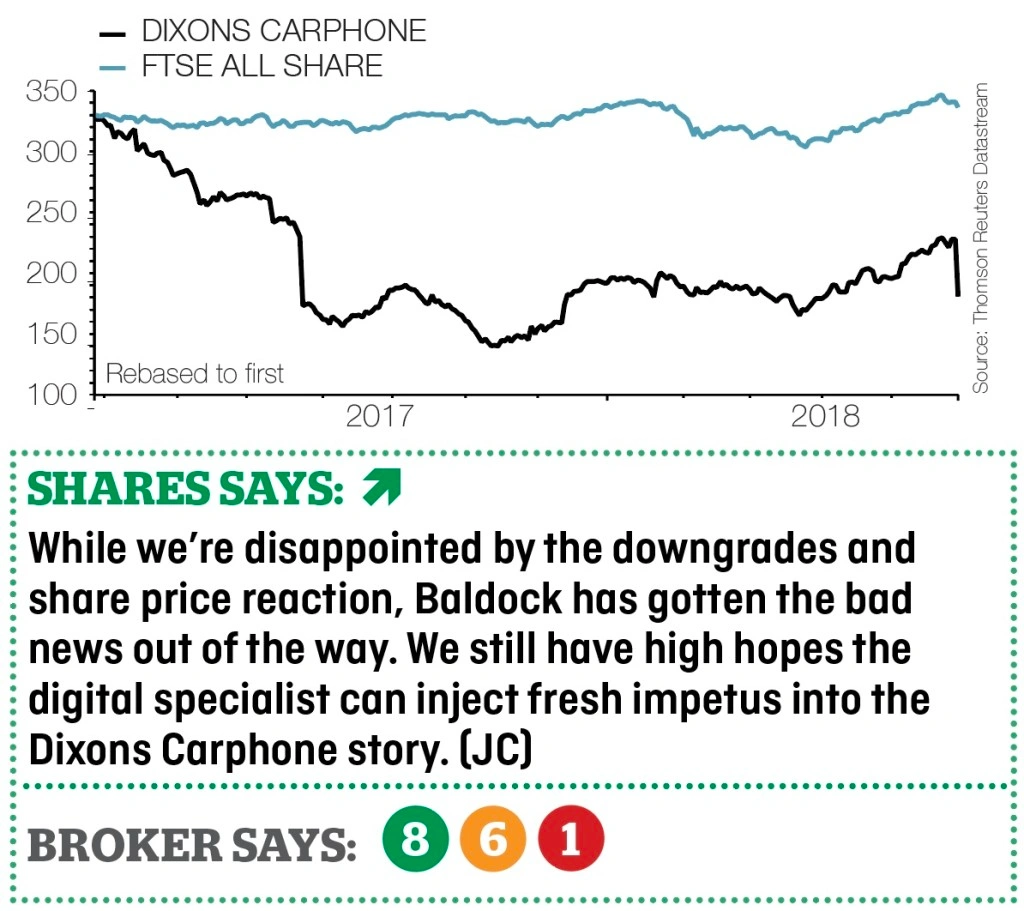

DIXONS CARPHONE (DC.) 192.65p

Gain to date: 1.2%

Our bullish call on retailer Dixons Carphone (DC.) remains modestly in the black despite a punishing profit warning (29 May) which called a halt to a recent rally in the name.

In his first trading update, new CEO Alex Baldock carried out a classic kitchen sinking exercise, grounding expectations as he sets about injecting fresh impetus into the business.

While headline pre-tax profit of around £382m for the year ended 28 April will meet market expectations, the result will be well down on last year’s £501m.

The Currys PC World-to-Carphone Warehouse owner also warned profits for the current financial year will fall to roughly £300m, well short of previous expectations amid cost increases, problems in the mobile phone business and ‘further contraction’ in the UK electricals market.

Fourth quarter (Q4) UK & Ireland like-for-like sales growth was negligible, softer computing market conditions a headwind, although Dixons Carphone also reported Q4 like-for-like growth of 8% and 10% for the Nordics and Greece respectively and plans to maintain the full year dividend at 11.25p.

‹ Previous2018-05-31Next ›

magazine

magazine