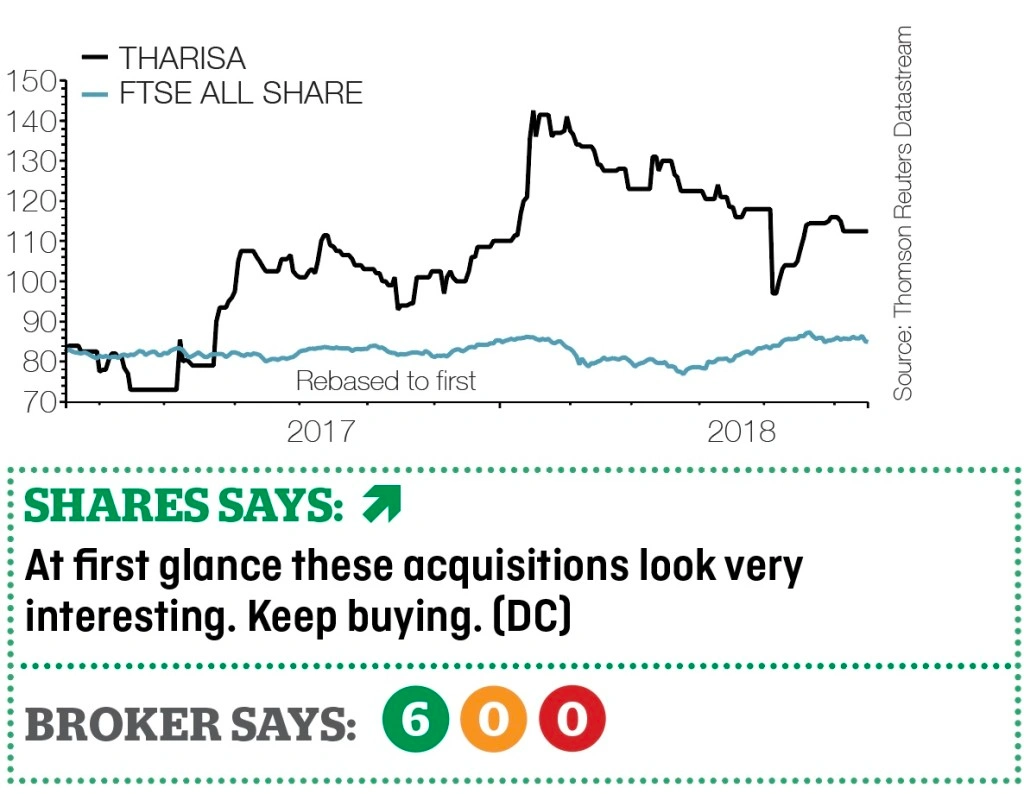

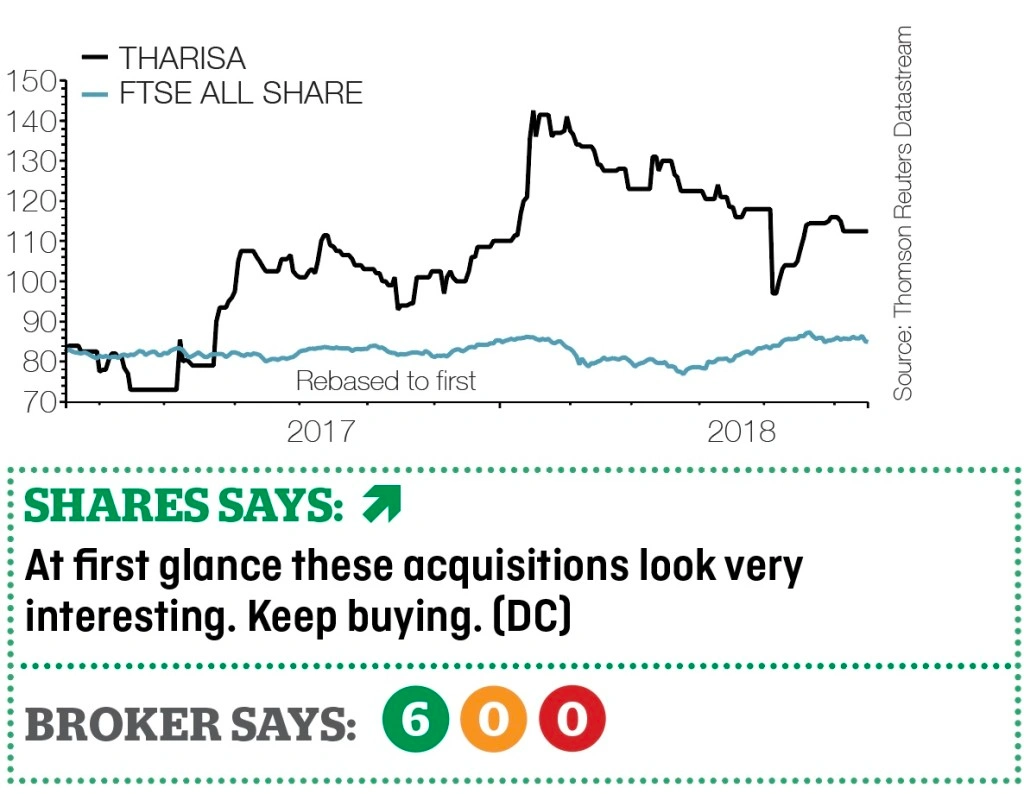

Tharisa (THS) 110.5p

Gain to date: 10%

The chrome and platinum miner has finally delivered on its promise to make an acquisition or two to boost its future production pipeline.

Two acquisitions have been made in Zimbabwe. The first is a 90% stake in Salene which owns an early-stage chrome project. ‘It has an easily accessible ore body and, having looked at other projects in Zimbabwe, we believe it should be a low cost mining operation,’ the company tells Shares. It hopes to build a pilot plant which could generate cash flow within 18 months.

The second deal is a 26.8% initial stake in Karo, owner of a highly prospective platinum group metals and base metal asset. Tharisa is confident of mining multiple open pits for nine years before going underground for 40 years.

The asset used to be owned by Zimplats but was relinquished under a government initiative to bring in new participants to the country’s

platinum industry.

Tharisa’s bull case for the project would require it to build a smelter and refining facility including spare capacity to treat material from other nearby mines. The first of four phases could see it start production in 2020.

The miner insists these investments won’t alter its current dividend policy.

‹ Previous2018-06-21Next ›

magazine

magazine