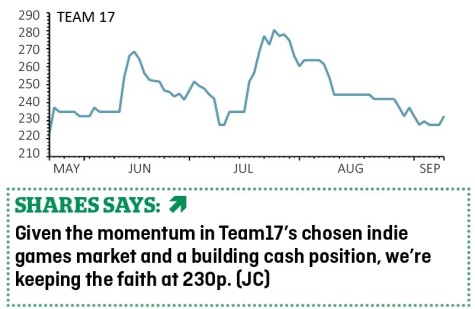

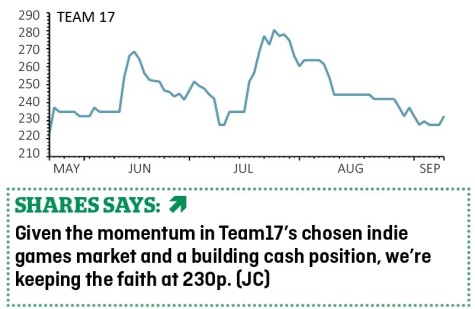

Loss to date: 8%

Although our ‘buy’ call on video games outfit Team17 (TM17:AIM) is in the red, we’re impressed by solid half year results (11 Sep) and the AIM newcomer’s future earnings growth potential.

One of the longest-running independent video games companies, Debbie Bestwick-led Team17 develops its own games and helps independent creators bring their games to market; the focus is on premium rather than free-to-play games and Team17’s winning portfolio includes Overcooked and the Worms franchise.

For the six months to June, revenue shot up 48% to £15.4m and adjusted EBITDA rose 36% to £4.9m, although taxable profits were lower after IPO-related costs.

As expected, the full year performance will be second-half weighted due to the usual games release schedule. Revenue growth is set to be driven by new product launches and continued growth from a strong back catalogue.

New franchises include My Time at Portia, the first game published by Team17 with a Chinese label partner, as well as Yoku’s Island Express.

Gross margins will also improve in the second half driven by the revenue mix.

‹ Previous2018-09-13Next ›

magazine

magazine