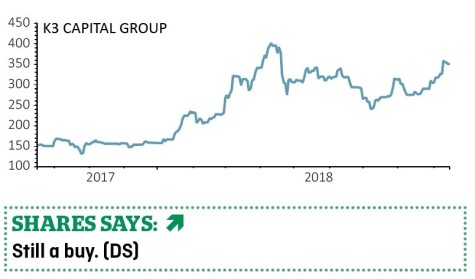

K3 Capital (K3C:AIM) 341p

Gains to date: 52.2%

Advisory firm K3 Capital (K3C:AIM) is a market leader in its niche, topping the Thomson Reuters league table for most active dealmaker in the small cap space for 2017 and the first half of 2018.

Its recent full year results (11 Sep) lead us to reaffirm our backing for this growth machine.

Revenue grew by 53% to £16.5m and pre-tax profit increased by 103% to £7.3m. Othe notable metrics include a 121% increase in its net cash position to £7.5m with earnings per share up 114% to 14.1p.

Speaking to CEO John Rigby, he says that while other advisory firms are given mandates by the big consultancy firms, K3 goes out and wins its own business through targeted marketing.

The fees the company receives for completed deals have grown materially, starting at £7,000 and now £63,000. This is has underpinned the step change in profitability.

Rigby says K3 has another trick up its sleeve with a new business, KBS Capital Markets, which should be up and running soon.

‹ Previous2018-09-20Next ›

magazine

magazine