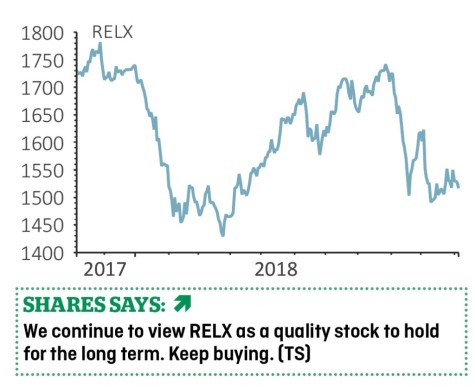

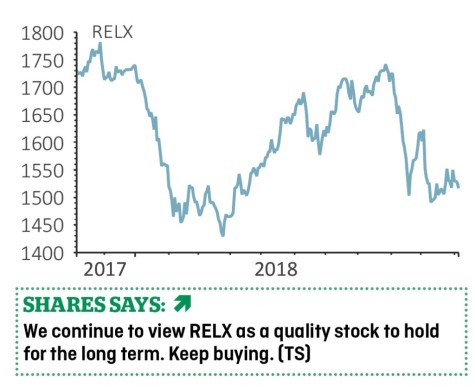

RELX (REL) £15.31

Gain to date: 2.1%

The wider market correction has taken some of the shine off RELX’s (REL) shares but the publishing firm remains a bastion of reliability as reflected in its recent nine-month trading update (25 Oct).

This reaffirmed full year guidance with underlying revenue growth for the period of 4%, bang in line with the recent trend.

RELX augments this steady growth with M&A activity and has acquired seven assets for a combined £943m year-to-date while selling four assets for £28m.

The Scientific Technical Medical division, a key concern for the market given fears that education institutions might push back on the pricing of academic journals, managed reassuringly solid growth of 2%, although this was down slightly on the 3% growth seen in the first half of the year.

The company has also completed a simplification of its structure whereby the Anglo-Dutch firm has abandoned its dual-share structure and retained a PLC listing in London.

Numis analyst Steve Liechti says that ‘against a volatile broader market backdrop RELX remains a safe place to hide in the media sector’.

‹ Previous2018-11-08Next ›

magazine

magazine