The latest Rightmove house price survey has added to the gloom surrounding UK housebuilders which have also been caught up in Brexit-related market concerns.

The average UK asking price this month is £5,200 or 1.7% lower than October at £302,000, according to Rightmove. This is the biggest drop in prices for the month of November since 2012.

Worse, on a year-on-year basis prices are down 0.2% in November, the first negative annual reading for seven years.

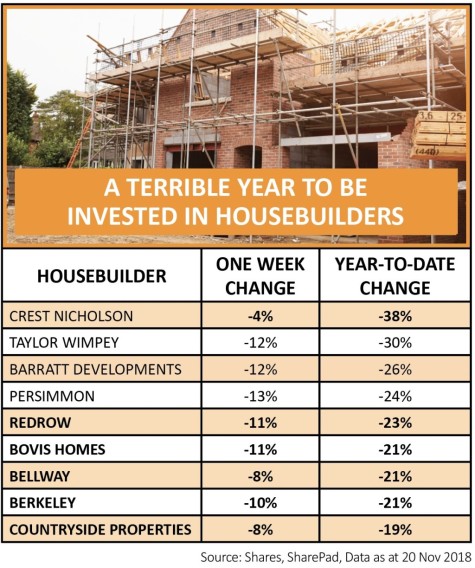

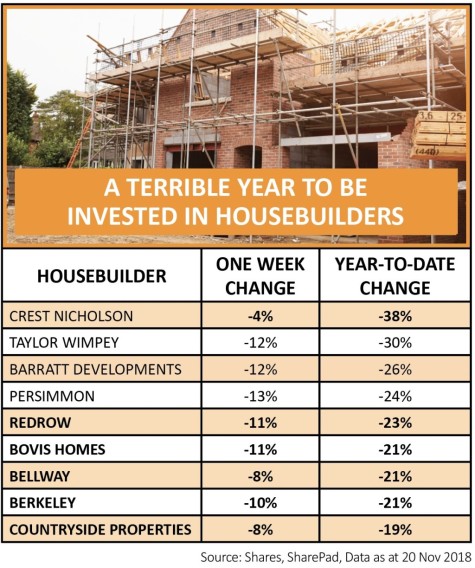

Anyone owning shares in housebuilders will have endured a difficult time in 2018, as illustrated by the accompanying table.

The last Halifax house price survey for October showed that annual growth last month was the slowest in five years at 1.5% while the Nationwide survey showed growth at its slowest since May 2013 although in both cases it was still positive.

All three surveys point to average house prices peaking in July then falling slowly over the summer.

The surveys all suggest that first-time buyer transactions are picking up slightly but they all show this being offset by a dramatic drop in buy-to-let demand.

This is due to a combination of a less-favourable tax treatment, tougher underwriting standards by mortgage lenders and lower demand for rented accommodation.

Regionally, London and the South East have been the weakest areas for some time but East Anglia and the South West have also slipped of late. According to the Rightmove survey every region of the UK has seen price falls in November.

With the supply of new houses tight, interest rates still at affordable levels, unemployment at a 40-year low and wages rising faster than consumer prices these should be salad days for companies linked to the property market.

Instead falling prices are putting punters off and buy-to-let, which looks to have been one of the biggest drivers of the market over the last seven years, seems to be in retreat. (IC)

‹ Previous2018-11-22Next ›

magazine

magazine