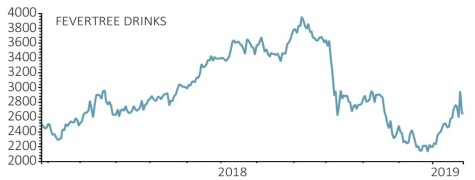

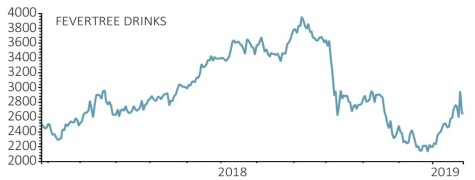

Fevertree Drinks (FEVR:AIM) £26.01

Gain to date: 17.7%

After a seemingly interminable wait investors were rewarded last week with a trading update from Fevertree (FEVR:AIM).

Revenue for the year to the end of December was up 39%, driven by a 52% increase in UK sales thanks to ‘outstanding’ summer trading and a strong performance over Christmas.

Sales in Europe accelerated in the second half to end the year up 24% and sales in the crucial US market rose 21%.

Fevertree signed a new US distribution deal last August and growth for the second half of the year was 27% compared with 15% in the first half.

The US market is a potential game-changer for Fevertree given its size and the trend towards premiumisation in mixers.

The shares jumped 13% to £29.48 on the day of the update only to reverse by 10% the day after to £26.49 as the ‘hot money’ banked some profit.

SHARES SAYS:

We made Fevertree one of our top picks for 2019 at £22.10 and we see no reason why the shares shouldn’t continue to perform well this year.

Sales in the UK and Europe are still growing fast and as the brand takes off in the US earnings should also rise rapidly.

‹ Previous2019-01-31Next ›

magazine

magazine