A recommended $43bn takeover offer for WorldPay (WPY) from US financial technology firm FIS shows the value placed on payment processing assets amid structural growth in digital payments.

It also emphasises the need for scale in this space and highlights the M&A surge seen so far in the first quarter of 2019.

Worldpay, which was taken over by US peer Vantiv only two years ago, processes upwards of 40bn payment transactions a year across hundreds of countries and currencies.

Its leading position in e-commerce payments should position it to benefit from the ongoing increase in the amount of shopping done online across the globe. This clearly appealed to FIS which provides software for payment processing and other services to the banking industry.

Under the terms of the deal Worldpay shareholders are principally being paid in FIS stock (listed on the New York Stock Exchange) with a relatively modest cash element.

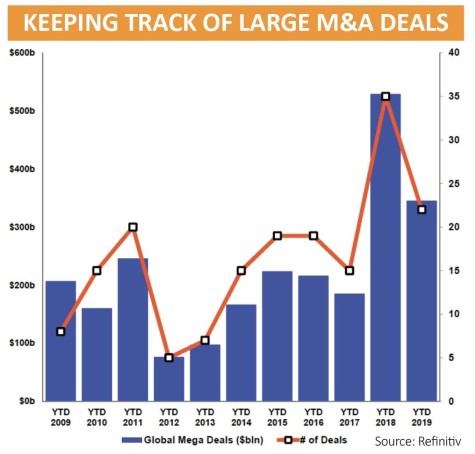

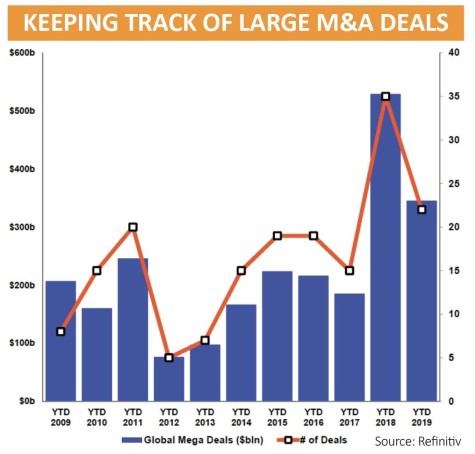

Interestingly, it is second largest mega-deal of the year worldwide according to financial data group Refinitiv, with mega-deals defined as $5bn and upwards. The year-to-date total value of such transactions has hit $354.3bn.

At the same point last year, the total value of global mega-transactions was more than $500bn but as the chart demonstrates that was an exceptional period and transactions tailed off amid market turbulence in the second half of 2018.

Many of the conditions to stimulate deal-making remain in place. Debt is still cheap and freely available with the US Federal Reserve seemingly hitting pause on rate rises. Most estimates put corporate cash piles in the US alone at more than $2trn. Analysis by US publication Business Journals put the total at $2.7trn in December 2018.

Weaker market sentiment amid signs global growth is beginning to wane may affect corporate appetite to spend large amounts of money.

‹ Previous2019-03-21Next ›

magazine

magazine