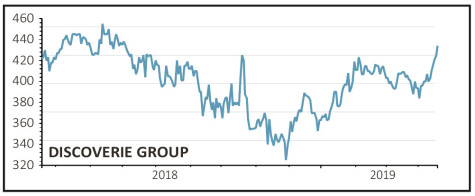

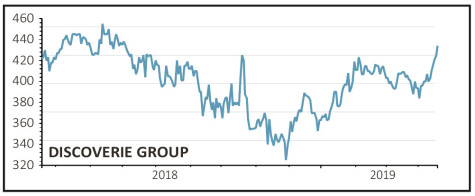

DISCOVERIE (DSCV) 434p

Gain to date: 6.9%

Enhanced growth prospects and reduced debt is how one analyst describes the latest situation for electronics engineer DiscoverIE (DSCV).

Last week the company forked out £15.9m on a pair of custom design engineering businesses – Hobart Electronics and Positek – with manufacturing in the US and Mexico.

The deals should provide cross-selling opportunities in time, plus some potential for stripping out operating costs.

Both Hobart and Positek underscore a key theme of our original investment idea – namely that DiscoverIE is stepping into higher margin projects through complex design and manufacturing rather than just distributing parts.

A £29m fundraise will help to pay down borrowings, taking net debt-to-EBITDA (earnings before interest, tax, depreciation and amortisation) from approximately 1.9 to 1.5-times. That leaves plenty of headroom for additional bolt-on acquisitions as opportunities emerge.

The stock has made reasonable progress in the short time since we first flagged the investment opportunity yet DiscoverIE still trades at a 15% to 20% discount to peers.

SHARES SAYS: A clear vision and strategy to execute, analysts see 500p as a 12-month target for the stock. We think the upside could be greater.

KEEP BUYING

‹ Previous2019-04-25Next ›

magazine

magazine