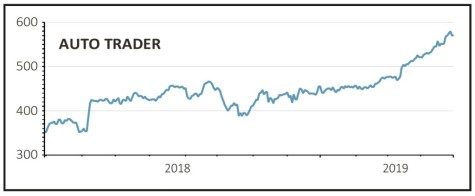

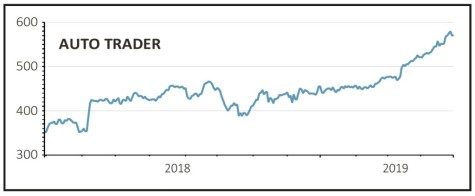

Auto Trader (AUTO) 574.8p

Gain to date: 52.2%

Our view nearly a year ago that the market had called it wrong on Auto Trader (AUTO) has been vindicated. The shares have increased by more than 50% in value and the stock even motored into the FTSE 100 at the end of 2018.

Despite fears over the UK car market and a competitive threat from online rivals, the car listings website has demonstrated its ability to continue growing earnings by squeezing more out of the retailers which buy its subscription products.

Half year results announced in November showed revenue up 7% to £176.8m with average revenue per retailer forecourt per month increasing £152 to £1,826 and earnings per share up 12%.

However, on 29 April the company announced the man who had led the company through its successful IPO and to a strong start as a public company, Trevor Mather, will step down at the end of the current financial year in March 2020.

He will be a hard act to follow for his replacement Nathan Coe, currently the finance chief at the company. A price-to-earnings ratio of more than 23 times March 2020 forecast earnings leaves limited margin for error.

SHARES SAYS: While we like the business, the valuation now looks more stretched and a change at the top represents a good opportunity to take profit.

‹ Previous2019-05-02Next ›

magazine

magazine