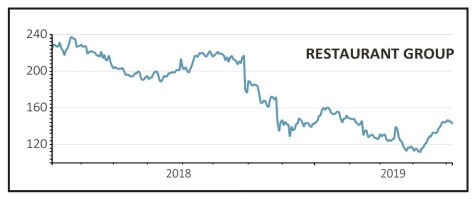

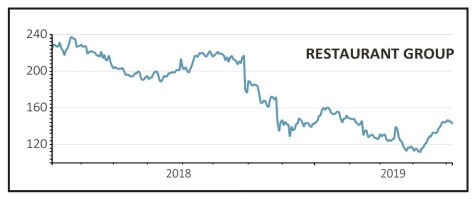

Restaurant Group (RTN) 147.9p

Gain to date: 30.6%

Last month we flagged to the appointment of a new chief executive as a potential catalyst for shares in Restaurant Group (RTN) but we admit to being a little surprised at the identity of the new person in charge.

The incoming boss Andy Hornby is likely to be most familiar with investors from his spell in charge of bank HBOS during the financial crisis, when the company had to be rescued in an emergency takeover by Lloyds (LLOY).

While this is hardly the best calling card, Hornby has held several executive roles out of the spotlight in the intervening period, including a spell in charge of Alliance Boots and more recently as co-chief operating officer of gambling firm GVC (GVC). He enjoyed a successful spell at Coral before its merger with Ladbrokes and subsequent takeover by GVC.

Shore Capital analyst Greg Johnson for one is impressed, saying: ‘He brings significant experience in retail, M&A integration and also new channel distribution, which will be increasingly key, especially given the acquisition of Wagamama.’

SHARES SAYS: It is probably fairer to judge Hornby on his recent track record which is more encouraging than his HBOS days. Keep buying.

‹ Previous2019-05-09Next ›

magazine

magazine