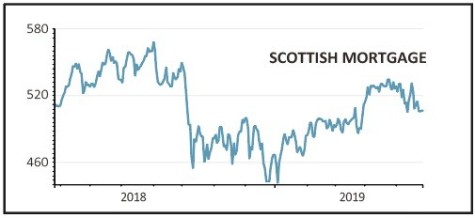

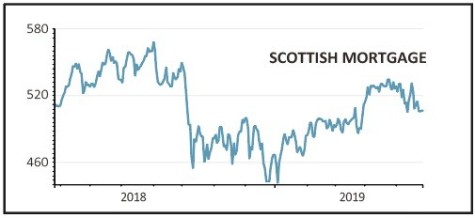

SCOTTISH MORTGAGE INVESTMENT TRUST (SMT) 507.5p

Gain to date: 5.4%

Technology heavyweights continue to drive performance at Scottish Mortgage (SMT), one of the UK’s most popular investment trusts with retail investors.

Online shopping giant Amazon, DNA technology designer Illumina, Chinese tech firm Alibaba, plus the US listing of ride hailing firm Lyft all added to the trust’s net asset value (NAV) in the 12 months to 31 March 2019, with Gucci-owner Kering also performing well.

This helped NAV rally 14.6% during the year to £8.13bn, far outstripping the 9.9% equivalent return of the global index average. That the share price increased by 16.5% over the same time frame is a firm illustration of real shareholder returns.

Scottish Mortgage has significantly bolstered stakes in the likes of Delivery Hero and Spotify, although some readers will be less impressed by its still firm commitment to Tesla.

But to judge Scottish Mortgage on annual performance is to miss the long-term point, one its managers hammer home in the results. NAV has increased 152.7% and 647.4% over five and 10 year periods respectively, while the shares have rallied 157.1% and 737.3%.

SHARES SAYS: A superb investment for those with a longer-run view, our enthusiasm remains undiminished. Still a buy.

‹ Previous2019-05-30Next ›

magazine

magazine