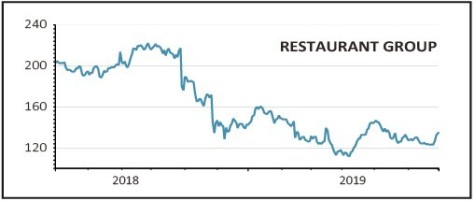

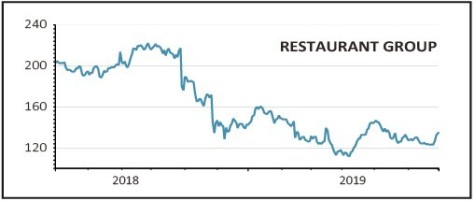

Restaurant Group (RTN) 135.1p

Gain to date: 19.3%

Shares in Restaurant Group (RTN) rallied after we said to buy in April. Having eased back slightly in the past month, the stock is now back on an upwards trajectory after investment bank Berenberg found evidence that consumers were warming to one of the group’s main brands again.

It compared the latest TripAdvisor ratings for Frankie & Benny’s restaurants in 10 UK cities versus scores in March 2018 and found a marked improvement.

‘The improvement in Frankie & Benny’s reviews could lead to customers visiting more frequently and may help to bring lapsed customers back to the brand,’ says the investment bank.

It did the same analysis for Wagamama sites and found that consumers still like the brand even after it was bought by Restaurant Group last year.

And to get a more balanced view Berenberg analysed reviews for rival outlets Nando’s and Zizzi and found that neither of those brands’ ratings had improved this year.

Berenberg believes the Wagamama acquisition will be earnings-dilutive in the first year of ownership but significantly earnings-accretive by year three.

SHARES SAYS: The recent bout of rainy weather may have disrupted trading for Restaurant Group but that would only be a short-term issue. We’re buying into the recovery story which certainly looks like it has legs. Stay positive.

‹ Previous2019-07-04Next ›

magazine

magazine