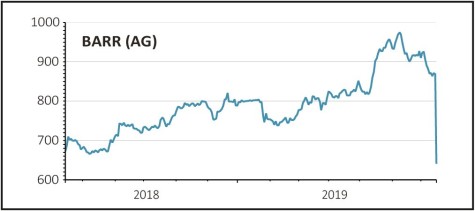

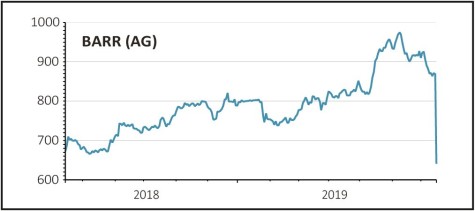

A.G. BARR (BAG) 653.6p

Loss to date: 20%

Sadly, our recent ‘buy’ call on Irn-Bru maker A.G. Barr (BAG) has seen its 20% stop loss triggered following a profit warning. Naturally we are disappointed by the magnitude of the ensuing earnings downgrades, but we remain bullish on its long-term potential and would use the opportunity to buy more shares at the lower price.

A.G. Barr says trading is below expectations, partially due to a strategy shift from a heavy focus on driving volume last year back to prioritising value now. This has been exacerbated by some brand challenges, as well as disappointing weather.

Against a prior year comparative boosted by 2018’s summer heatwave, A.G. Barr expects sales for the 26 weeks to 27 July in the region of £123m, roughly a 10% year-on-year decline. Due to operational gearing, full year profits are expected to drop by up to 20% and investors should also brace themselves for results marred by exceptional costs as A.G. Barr seeks to restore trading momentum.

SHARES SAYS: Downpour-induced downgrades are disappointing short term, yet A.G. Barr says it has addressed the specific brand-related issues and we remain convinced the Irn-Bru maker can continue to compound earnings on a long-term view. Investors prepared to show patience should view the sell-off as a buying opportunity.

‹ Previous2019-07-18Next ›

magazine

magazine