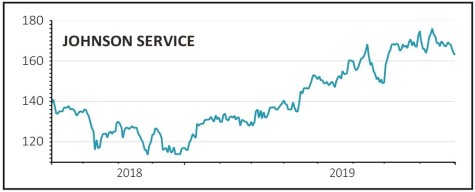

Johnson Service Group (JSG:AIM) 165p

Gain to date: 27.9%

Original entry point: Buy at 129p, 7 March 2019

Our ‘boring is beautiful’ call on catering and workwear hire and laundry firm Johnson Service continues to deliver as the half-year results show.

Revenue was up almost 10% with like-for-like growth of 7.5% thanks to strong demand and higher prices. Since the end of June demand has continued at such a pace that the firm has increased its full year sales and profit guidance.

The group prides itself on the quality of its service and delivery, and this is reflected in high customer satisfaction ratings and retention rates. Happy customers mean repeat sales, but there have been some significant new contract wins as well.

In order to manage this growing demand, especially from the hotel, restaurant and catering sectors, a new plant is opening in Leeds next spring. As well as servicing customers in the north of England the plant will take in work from existing plants, freeing up capacity to service new customers.

Given how strong organic growth was in the second half of last year we’re impressed that the firm has increased guidance for this year and would continue to buy the shares.

SHARES SAYS: This is a great long-term growth story which still isn’t widely known by retail investors.

‹ Previous2019-09-05Next ›

magazine

magazine