magazine 12 Sep 2019

Download PDF Page flip version

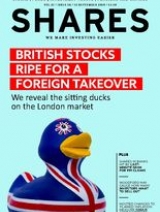

Brexit fears and a weak pound have made large chunks of the London market look very cheap to foreign buyers, leading to a new wave of takeover deals. Shares magazine examines the market and highlights five potential takeover targets.

Also this week: a rush of PPI claims hurts shares in Lloyds and other banks; and Woodford may gauge demand ahead of suspension lifting for investors wanting to sell out of its income fund.

Shares analyses Next’s business model, it explains how certain funds are awarded five-star ratings, and it weighs up the difference between ETFs and traditional tracker funds.

You can also read about AstraZeneca, Centrica, EasyJet, Synthomer and more

Mark from Edinburgh is taking higher risks in an effort to hit a number of goals

A weak currency and cheap valuations make the UK a happy hunting ground for deal-makers

Can the likes of International Consolidated Airlines and Ryanair win back the market’s favour?

Analysts consider the potential price tag for mooted asset sales and whether it could be a takeover target

The administrator of the troubled income fund is understood to be weighing up a 14 day pre-dealing period

Investors are now worried about the impact PPI claims will have on dividends

The FTSE 100 stock is one of our favourite companies on the London Stock Exchange

Independent ratings systems are a vital tool in your armoury when it comes to assessing funds

Trusts using debt to supercharge returns can incur problems in a market downturn

New research shows why you shouldn’t ignore an earnings alert from something in your portfolio

His actions have put the spotlight back on something called ‘the Triffin dilemma’

Dropping RPI inflation could have a negative effect for pensioners and investors

Contrarian investment trust targets beaten down stocks with the potential to rebound

The company should benefit from capacity expansion and a deal to boost its position in the US and Europe

Shares in the pharma business hit by reports of potential price controls on US drugs

Half-year results were very disappointing so time to sell the shares

A reader approaching retirement asks if they should bring forward their de-risking plans