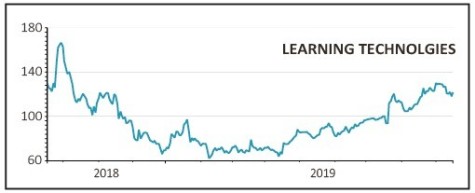

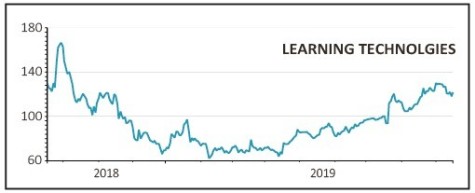

LEARNING TECHNOLOGIES (LTG:AIM) 119.8p

Gain to date: 59.7%

Half year results from corporate online trainer Learning Technologies (LTG:AIM) continued the positive trends since we said to buy in April.

The first half numbers were solid with performance bolstered by recent software-focused acquisitions which continue to aid operating margins, rising from 24.6% to 31%.

In five months the stock has soared roughly 60%, but we see more gains to come. Further share price gains are likely to be driven by existing scope to beat current expectations this year and beyond, which call for operating profit of £38.3m and £42.2m respectively in 2019 and 2020, according to data from Refinitv.

Our optimism is predicated on securing larger contracts as the company has scaled itself, with better long-run client retention, and above all, extra profit margin improvements.

Overall, Learning Technologies averages just 1.2 products per customer at present, versus nearer four across its top 10 customers, so it is still early in the company’s potential cross-selling cycle.

That would go some way to scratch one of the remaining performance itches; relatively slow organic growth.

SHARES SAYS: Keep buying the shares.

‹ Previous2019-09-19Next ›

magazine

magazine