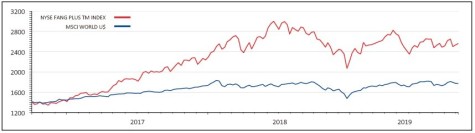

The leading US technology shares known as the FAANGs, an acronym for Facebook, Apple, Amazon, Netflix and Google, have led the stock market higher during the past five years, outperforming the MSCI World index by 139% since October 2014.

However on a relative basis the group has started to lag the broader market since peaking in June 2018 and has underperformed by 15%. This is based on analysis of the NYSE FANG+ index which also includes the shares of Alibaba, Nvidia, Tesla, Baidu and Twitter.

The biggest contributors to the weakness have come from shares in Netflix which has dropped by 35% since the index peaked last the summer, and Nvidia whose shares are down by 37%. The launch of streaming services by Disney and Apple haven’t helped sentiment towards Netflix, especially given its sky-high stock rating.

Even Amazon has seen its shares fall by 16% since the index peak in 2018. The best performer of the bunch has been Apple, whose shares are around the same level as last year.

The waning appeal of technology has also been seen in the poor performances of new stock market flotations such as ride sharing app company Lyft which has seen its shares almost halve since listing this year, with bigger competitor Uber showing a 37% fall since coming to the market in May.

One limiting factor to the FAANGs’ future performance is related to the sheer size of some of its constituents such as Apple with its $1trn market capitalisation. As companies get bigger the growth rate naturally tails off due to the fact that the base value of revenue and profit is larger.

There is a natural life cycle to the development of most companies. You could easily make the case that Apple’s product cycle is entering the mature or mid-life stage, where growth opportunities are relatively limited.

For Apple, you could argue that its prospects are at least reflected in the undemanding rating of around 19 times forward earnings per share.

You could make the case that price action is finally catching up with the underlying rating of the FAANGs which peaked at 73 times one-year forward earnings per share five years ago and currently sit at 43.5-times according Ed Yardini research.

In that time the group’s share of the S&P index in the US has grown from around 7% to close to 18% at the peak. Ultimately, the increased size of this much lauded group of stocks will act as an impediment to further relative progress.

‹ Previous2019-10-10Next ›

magazine

magazine