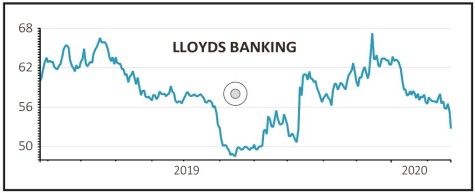

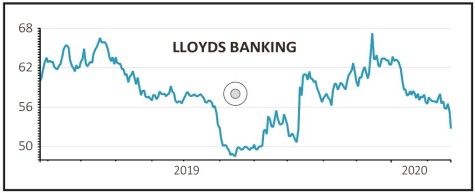

Lloyds Banking (LLOY) 52.55p

Loss to date: 17.8%

Original entry point: Buy at 63.93p, 19 December 2019

Our positive call on Lloyds Banking (LLOY) is off to a slow start. However, while full year results (21 Feb) didn’t deliver a full endorsement of our view, we do see some signs of encouragement.

The company’s numbers were marred by PPI claims – which totalled £2.5bn for the year. However, three key things lead us to believe that the company’s situation could look brighter through the course of 2020.

First the concern which had been building about its balance sheet seemed to be allayed as the company’s common equity tier one ratio (a key measure of a bank’s ability to weather financial shocks) came in at 13.8%, above expectations.

Management also stuck with its 13.5% target. There was previously concern in the market that this might need to be increased, potentially threatening capital returns to shareholders.

Second Lloyds reiterated its 2020 capital generation targets, underpinning the dividend and providing some hope that share buybacks abandoned at the third quarter stage might be resumed soon.

Finally the business is seeing signs of improvement in the UK economy on which it is heavily reliant – chief executive Antonio Horta-Osorio pointed to ‘a clearer sense of direction and some signs of an improving outlook’.

SHARES SAYS: Keep buying.

‹ Previous2020-02-27Next ›

magazine

magazine