With the world paying more attention to health issues, drug companies are likely to be more in demand with investors as the year progresses. There is a big opportunity to buy cheaply now before the tide turns.

Large cap biotechnology companies are trading at one of their largest valuation discounts to the S&P 500 index in decades. The one-year forward price-to-earnings (PE) ratio has fallen from 26 times in 2012 to the current 10 times, as the sector has been de-rated, with share prices lagging earnings growth.

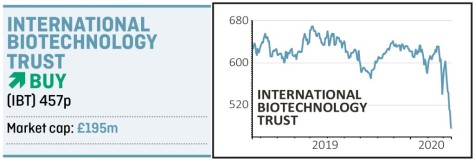

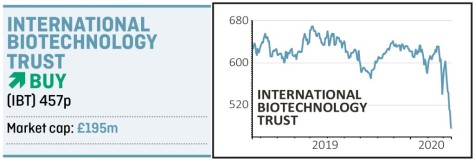

International Biotechnology Trust (IBT) is a good way to get exposure to an industry which has historically grown faster than the economy due to long-term sustainable factors, and which is currently trading at a large discount.

At the peak over the past year the investment trust traded at 5.8% premium to net asset value. Now it is trading on an absolute bargain discount to NAV of 18.5%. It pays 4% of its assets as a dividend, semi-annually. The manager is also buying back shares.

The trust is managed by an experienced team which has been investing in the sector for 30 years. The strategy has a few features which gives the fund’s assets defensive characteristics, to add to the clear growth opportunity.

Unlike some peers the IBT team mitigate specific risks around drug trials by reducing exposures ahead of key trial data releases, as well as using proprietary valuation techniques to reduce positions where the risk/reward is considered unattractive.

The other key defensive feature of the strategy is the diversification across companies at different stages of commercialisation. Of the portfolio’s 101 holdings only 23% are exposed to developmental stage companies, compared to around 40% of the companies in the portfolio which are profitable.

The portfolio is diversified across therapeutic areas with a particular focus on drugs and therapies which have pricing power, making the portfolio robust. Oncology (cancer) represents around a third of the portfolio, rare diseases a quarter and central nervous system drugs another 11%.

The trust’s second biggest holding is US life sciences company Gilead, which owns a very stable HIV franchise, and its Ebola drug remdesivir is in human trials for the coronavirus in Wuhan, ground zero for the outbreak.

IBT provides exposure to both income and growth and the current market sell-off provides an opportunity to buy the trust at a really good price.

‹ Previous2020-03-19Next ›

magazine

magazine