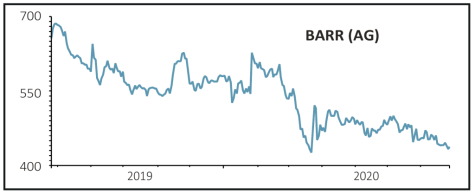

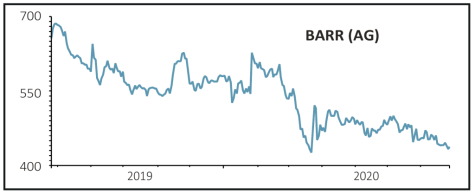

AG Barr (BAG) 437.21p

Loss to date: 12.5%

Original entry point: Buy at 499.5p, 7 May 2020

We said to buy the Irn-Bru maker in May, believing that its share price didn’t warrant being so low. A new trading update confirms that the initial lockdown period wasn’t good for sales, which shouldn’t be a surprise. More encouraging is news that sales from both the hospitality sector and consumers ‘on the go’ are starting to pick up.

Anyone investing should really take a long-term view of a business and not simply base their decision to buy or sell on just a few months’ trading.

AG Barr continues to generate positive cash flow and we have faith in it getting through the current difficult period.

Liberum says the 8% decline in first-half revenue to £113 million was much better than its forecast for £94.6 million in sales. ‘The material beat versus our expectations appears driven by a strong performance in the impulse channel as AG Barr helped independents navigate the shift to take-home occasions from immediate consumption,’ says the broker.

Assuming there are no major flare-ups of the virus in the UK, Liberum believes AG Barr could think about restarting dividends when it reports half-year results on 22 September. ‘The share price fall (-25% year to date) is at odds with this strong update,’ it adds.

SHARES SAYS: AG Barr is getting back on its feet so use the ongoing share price weakness as a reason to buy more shares as a long-term investment.

‹ Previous2020-07-30Next ›

magazine

magazine