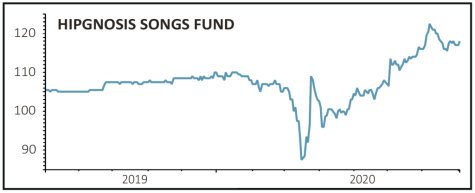

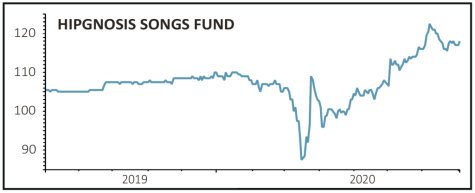

HIPGNOSIS SONGS FUND (SONG) 116.75p

Gain to date: 1.1%

Original entry point: Buy at 115.5p, 18 June 2020

Having reached 122.5p in July, Hipgnosis Songs Fund (SONG) has settled back to 116.75p with additional shares hitting the market through a successful July fundraise. Yet our ‘buy’ call on the music royalties specialist remains in positive territory and Hipgnosis continues to bolster an impressive catalogue of winning songs.

Among the more noteworthy is the acquisition of song writing legend Barry Manilow’s music royalty catalogue, for an undisclosed sum.

Hipgnosis Songs Fund buys and owns the rights to certain pieces of music and receives a royalty payment each time they are played on the radio, streamed online, feature in adverts, films, TV programmes or computer games, or are bought on CDs or vinyl.

This helps to fund an attractive stream of dividends and makes the music royalty fund attractive in an environment where dividends are being cut by many companies.

Investors are enthusiastic about the proposition, with Hipgnosis having raised more than £860 million through its summer 2018 IPO and subsequent issues in April 2019, August 2019, October 2019 and this July, when it raked in £236.4 million by issuing new shares at 100p per share.

Following this impressive spate of acquisitions and capital raises, other music royalty firms are thought to be considering IPOs, which could increase competition for assets in the future and is one risk factor to monitor.

SHARES SAYS: Keep buying.

‹ Previous2020-08-06Next ›

magazine

magazine