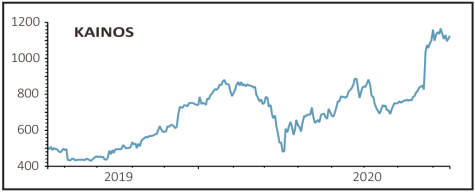

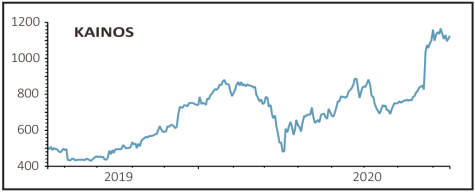

KAINOS (KNOS) £11.29

Gain to date: 57.2%

Original entry point: Buy at 718p, 19 December 2019

The positive news continues to flow around Kainos (KNOS), the digital transition consultancy that is one of Shares top picks for 2020.

This week analysts at broker Canaccord Genuity increased their target price for the stock by nearly 40%, from 860p to £12. In a note to clients, Kai Korschelt and Steve Robertson kick-started what they see as the beginnings of a cycle of likely forecast upgrades for the company.

‘Following Kainos’ recent upbeat trading statement we raise our sales forecasts by up to 3% and adjusted earnings per share (EPS) by up to 35%,’ the analysts wrote. This reflected ‘strong demand for digital transformation services and lower costs’ on the back of the Covid-19 pandemic and expanding margins this year as a result.

On 27 July Kainos declared a 6.7p per share special dividend and told investors to expect results for the year to 31 March 2021 to put previous forecasts to the sword. ‘We expect revenue to be well ahead and adjusted profit to be substantially ahead of current consensus forecasts for the full year ending 31 March 2021,’ the company told investors.

That news saw the share price roar 25% higher on the day, a run that has continued since, for a 57% gain so far this year.

SHARES SAYS: Kainos remains an outstanding, if expensive stock worth owning for the longer term.

‹ Previous2020-08-20Next ›

magazine

magazine