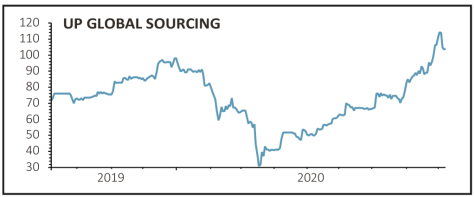

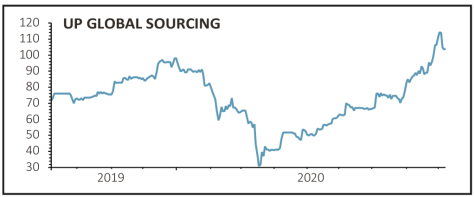

UP Global Sourcing (UPGS) 102.1p

Gain to date 8.9%

Original entry point: Buy at 93.7p, 27 August 2020

Owner of value-focused consumer brands UP Global Sourcing (UPGS) delivered on its guidance for full-year earnings before interest, tax, depreciation and amortisation, reporting £10.4 million on 7 September, down 3.3% year-on-year.

The trading statement prompted Shore Capital to reintroduce medium-term forecasts with the broker looking for mid-to-high single digit growth which it believes ‘offers upside risk, reflecting the group’s broadening channel and customer mix’.

UK and international online sales were up 47.2% to £16.7 million and accounted for 14.5% of group revenues, up by more than half from the 9.2% last year. Meanwhile the concentration of customers reduced significantly with the top two names now accounting for around a fifth of group sales, down from almost 35% in 2019.

The tight management of working capital and accelerated turnover of inventory that was a feature of 2020 is expected to reverse next year as normal trading and ordering patterns emerge.

With year-end net debt down to £3.8 million from £14.4 million, the company has considerable headroom of £21.3 million according to Shore Capital.

It is forcast to pay 4.2p in dividends for the year to July 2021.

SHARES SAYS: Still a buy.

‹ Previous2020-09-10Next ›

magazine

magazine