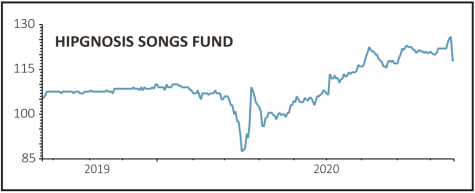

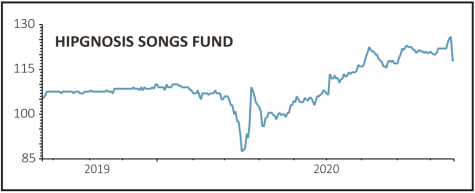

HIPGNOSIS SONGS FUND (SONG) 118.73p

Gain to date: 2.8%

Original entry point: Buy at 115.5p, 18 June 2020

Investors in Hipgnosis Songs Fund (SONG) must get used to the investment trust coming back to the market on a regular basis to raise money as it has grand plans.

In the summer it said there was a £1 billion pipeline of potential acquisitions, namely music catalogues where it obtains the rights to certain songs and enjoys royalty payments when they are streamed, appear on the radio, featured in adverts, films or TV shows, or played in shops, restaurants or gyms.

It raised £236.4 million in July and eyes another £250 million by issuing new shares at 116p, a 7.9% discount to the market price before the fundraising was announced and a 3.6% premium to its adjusted operative net asset value.

The new cash will buy more music catalogues, guided for a blended acquisition multiple of approximately 18 times historic annual income. That’s much higher than the 14.3 times average multiple paid to date and perhaps indicative of how competition is growing in the royalty space and how artists are becoming wise to the opportunity.

SHARES SAYS: Hipgnosis is strengthening its asset base from which to generate income and we expect to see a sizeable increase in the company’s net asset value when the revaluation of its library (likely using a lower discount rate) is announced in December.

‹ Previous2020-09-24Next ›

magazine

magazine