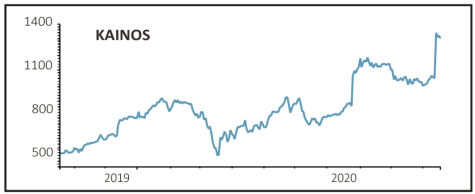

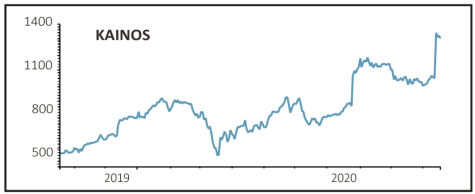

Kainos (KNOS) £13.10

Gain to date: 82.4%

Original entry point: Buy at 718p, 19 December 2019

Digital transition specialist Kainos (KNOS) continues to perform very strongly as it reveals further growth linked to the need for businesses and organisations to up their digital game amid Covid-19.

A trading update on 14 October revealed customer demand remained high and had resulted in a very strong trading performance from 1 April to date, driven by the structural shift of digital adoption.

It now expects results for the full year to March 2021 to be materially ahead of consensus for revenue and significantly ahead for profit – albeit this reflects some non-recurring efficiencies.

The company said its digital services customers continued to prioritise digital transformation programmes in the NHS and public sector.

Its workday practice continued to benefit from its international scale and an ability to secure new consulting contracts across all its geographies, Kainos added.

Shore Capital upgraded its revenue and adjusted pre-tax profit estimates by 8% and 45% respectively for the financial year ending 31 March 2021. ‘As a result, we are looking for 16% revenue growth to £207m and 88% adjusted pre-tax profit growth to £48 million in FY21.’

Results for the six months ending 30 September 2020 will be announced on 16 November.

SHARES SAYS: The company continues to deliver, keep buying ahead of first-half numbers.

‹ Previous2020-10-22Next ›

magazine

magazine