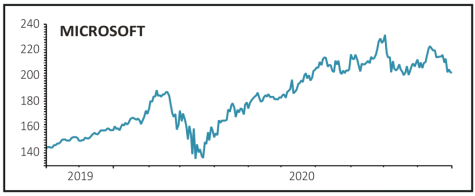

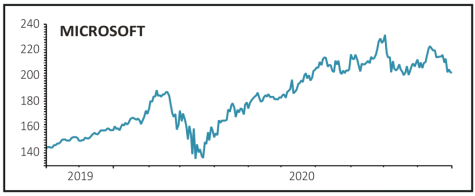

MICROSOFT (MSFT) $202.33

Gain to date: 22.6%

Original entry point: Buy at $165, 9 April 2020

Microsoft (MSFT) continues to make a mockery of forecasts as the wheel of fortune rolls its way. As we predicted back in April, work from home during the pandemic continues to spark rampant demand for its core software, cloud services, communication and gaming products, helping the world’s largest software company batter third quarter estimates.

In Late October the company reported fiscal first-quarter earnings to 30 September of $13.9 billion, or $1.82 a share (EPS), up from $1.38 a year ago and blasting past analysts’ EPS projections of $1.54. Revenue hit $37.2 billion, up from $33.1 billion a year ago and beyond the $35.8 billion consensus estimate.

What this shows is that, operationally, the company remains in clover and that the stock has justifiably earned its near-23% gains to date. True, guidance for the Christmas run-in was on the conservative side but it is largely price to earnings (PE) compression that accounts for the more recent soggy stock performance, the full year 2021 multiple down from 34 to 28 over the past couple of months.

SHARES SAYS: Microsoft remains a core long-term holding for investors, and is still a buy.

‹ Previous2020-11-05Next ›

magazine

magazine