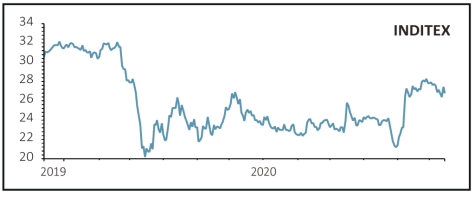

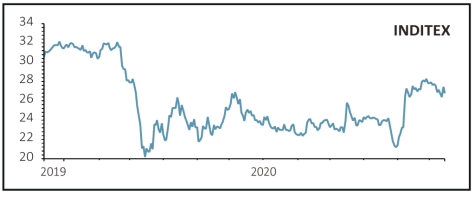

INDUSTRIA DE DISEÑO TEXTIL / INDITEX (ITX:BME) €27.50

Gain to date: 14.6%

Original entry point: Buy at €24, 8 October 2020

Spanish fashion house Inditex, which owns the Zara and Bershka brands among others, posted third quarter results in line with analysts’ estimates after a strong recovery in trading.

Most stores were open in the three months to October, and despite capacity and opening-hour restrictions sales improved markedly from the second quarter.

Online sales rose by 76%, helping total sales in the first half of October reach the same record level of 2019 before the latest restrictions came into force, beating expectations.

November sales were impacted by store closures, but crucially over 90% of the estate is open again for the key Christmas selling period.

Thanks to a 10% reduction in operating costs and the sale of some stores, the firm managed to hold its margin of earnings before interest, tax, depreciation and amortisation (EBITDA) to sales above 30%, quite an achievement given the surge in Covid-specific costs.

Total returns including dividends and gains from a stronger euro this quarter – and potentially an even bigger gain next quarter if sterling collapses on ‘no deal’ for trade between the UK and EU – make Inditex a useful hedge for UK investors.

SHARES SAYS: Keep buying.

‹ Previous2020-12-17Next ›

magazine

magazine