Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

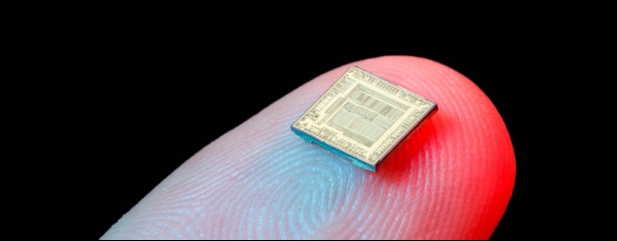

Supply deficit will create semiconductor winners

When one the world’s biggest microchip manufacturers talks about semiconductor supply shortages, it’s time to sit up and listen. Global car makers including Ford, Toyota, Nissan, VW and Fiat Chrysler have all had to scale back production this year, and now South Korean electronics giant Samsung has warned that chip shortages are spreading beyond the auto industry.

This is hardly surprising when microchips are being built into ever more products as part of the super-connected internet of things. Chips are now in everything from watches, fridges and ventilators as well as the tidal wave of tech devices we all rely on.

The semiconductor shortage can be traced back to the early stages of the pandemic when automotive demand collapsed. ‘Some semiconductor capacity was furloughed, and the rest switched to consumer electronics which performed very strongly with everyone working and learning from home,’ says Richard Windsor of research group Radio Free Mobile.

The shortage wasn’t caused by a single issue but by multiple factors conspiring to create the supply deficit.

These include the US/China trade war, fires, droughts and shock snowstorms in Texas which is a key US chip manufacturing hub. These factors have coincided with a period of soaring demand. In January alone, chip sales reached a record $40 billion, up 13.2% year-on-year. Manufacturers simply can’t produce them fast enough.

Current business models have also helped create a ticking timebomb, with an increasing number of semiconductor companies concentrating on chip design and outsourcing the manufacturing to other companies. That has added to the bottleneck.

‘This will sort itself out in a few quarters as inventory buying eases, supply chains stabilise and the world goes back to work,’ says Windsor.

Taiwan Semiconductor Manufacturing Company, one of the world’s largest semiconductor outsource manufacturers, has already lifted its 2021 capital spending budget to $28 billion but the industry cannot simply flick a switch to boost capacity. New plants cost billions to build and fit out and can take up to five years to complete.

Since stock markets bottomed about a year ago the sector benchmark Sox (Philadelphia SE Semiconductor) index has rallied nearly 130%. Shares spotted the opportunity early on, telling readers to invest in industry plays ASML in April 2020 and Texas Instruments and Lam Research in May and June, for an average 67% return to date.

Taiwan Semiconductor has forecast ‘multiple years of growth opportunities’ as the digital economy increasingly becomes ‘the’ economy. We expect chip demand to remain high, if somewhat cyclical, with the need for faster, smaller, more powerful and more complex semiconductors driving strong returns for the right companies and their investors.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine