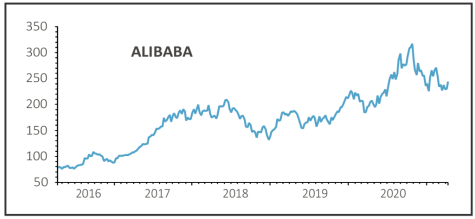

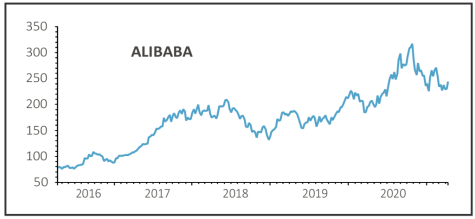

ALIBABA (BABA) $244.01

Loss to date: 4.8%

Original entry point: Buy at $256.22, 23 December 2020

A $2.8 billion antitrust fine by the Chinese authorities may look punishing for Alibaba (BABA:NYSE) but it effectively draws a line under an issue that has been dogging the shares for month. It represents barely 10% of the company’s annual free cash flow so is unlikely to hurt the company in the long run.

This point was reflected by the stock’s 9% rally earlier in the week. With the probe now closed, it was interesting that the regulator made a point of flagging how Alibaba as a business has largely been very positive for China and its people, nipping in the bud fears that the e-commerce platform was the target of a regulatory witch hunt.

Longer-term policy objectives designed to seed greater digital competition creates some debate about any impact on Alibaba’s future earnings, but the underlying growth story seems largely unchanged. We have seen no recent cuts to forecasts that imply 20%-plus earnings growth this year to March 2022.

On a 12-month forward price to earnings multiple of 21 versus 25 for its industry, Alibaba still trades at a near 20% discount to its peer group.

SHARES SAYS: Removing uncertainty around Alibaba is great news for investors and we expect the stock to kick on higher through the rest of 2021. Still a ‘buy’.

‹ Previous2021-04-15Next ›

magazine

magazine