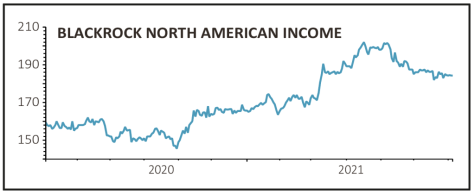

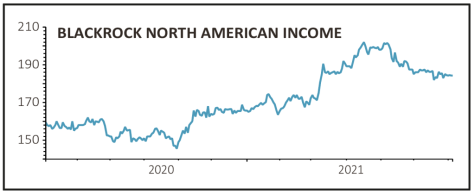

BlackRock North American Income (BRNA) 183.4p

Gain to date: 12.9%

Significant changes to the investment policy at BlackRock North American Income (BRNA), announced alongside its first half results (29 Jun), do not detract from our positive stance.

The announcement of a new sustainability strategy is likely to be welcomed by the market with the trust also planning to expand its focus to encompass mid cap firms alongside the large caps which currently dominate the portfolio and to look outside the US to Canada and other parts of North America.

This will also be a more concentrated portfolio going forward with 30 to 60 companies as opposed to the 80 to 120 currently targeted, with 86 held at present.

Numis says: ‘The decision to maintain the fund’s focus on value and dividend paying stocks appears sensible in our view, as many shareholders will hold the fund for income, rather than chasing performance.’

The changes are set to be put to a shareholder vote on 27 July, with a change of name to BlackRock Sustainable American Income Trust and a reduction in annual fees from 0.75% to 0.7%.

SHARES SAYS: The shift to focus more on sustainability makes sense and we are reassured that the income focus is being retained.

‹ Previous2021-07-08Next ›

magazine

magazine