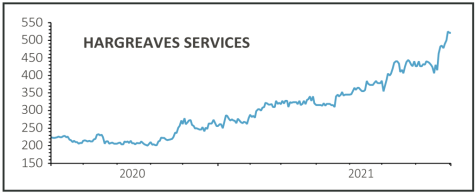

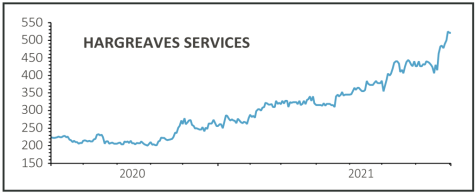

Hargreaves Services (HSP:AIM) 525p

Gain to date: 64%

Original entry point: Buy at 320p, 25 February 2021

The basis of our buy call in February was that the firm had reached a strategic turning point, divesting its coal assets and becoming a focused, self-financing industrial and property services group.

The cash received from the sale of inventories and the reduced working capital requirement thanks to exiting the coal business have transformed the firm’s finances, meaning it no longer has any bank borrowing and can fund itself from its own cash flows.

At the same time, having kept an 86% economic interest in its German joint venture HRMS, the firm cashed in on strong commodity markets with a significant rise in pre-tax profits in the year to May, leading to the reinstatement of the ordinary dividend plus a special dividend.

The service businesses – which comprise an environmental, logistics and minerals division, materials handling and mechanical and electrical engineering, and earthworks and infrastructure – have continued to deliver reliable and growing profits.

The land business – which provides sites for residential and commercial construction in northern England and Scotland – is benefitting from strong demand for houses and warehouses.

With the core businesses performing well and the option to monetise its stake in HRMS and release further capital there is still much to like about the stock.

SHARES SAYS: Keep buying.

‹ Previous2021-08-05Next ›

magazine

magazine