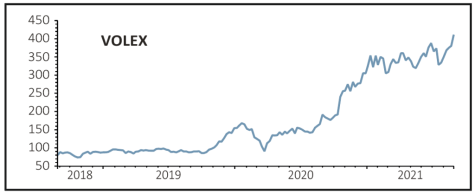

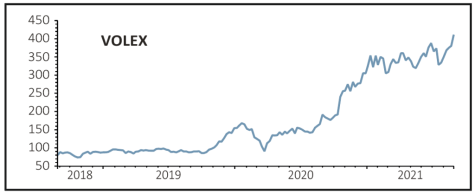

Volex (VLX:AIM) 412p

Gain to date: 10.8%

Original entry point: Buy at 372p, 24 June 2021

Power cords and cable assembly group Volex (VLX:AIM) is off to a decent start since we added it to our Great Ideas portfolio in late June.

The latest catalyst for the shares has been the $16.4 million acquisition of US electronic solutions manufacturer Irvine Electronics.

We flagged M&A as a key plank in the Volex’s growth strategy in our initial article as the group looks to hit its $65 million underlying operating profit and $650 million revenue targets by 2024 and this latest deal has received a positive reception.

Canaccord Genuity analyst James Wood said: ‘Irvine Electronics is a 30-year-old family-run business. We understand Volex has been talking to the owners for the last two years, with the sale driven by the recent retirement of the founders.

‘We believe the deal looks good value at 4.3-5.7 times earnings before interest and tax versus the six to eight times range that Volex typically strikes deals at and reinforces the group’s growing reputation as a patient and shrewd acquirer.’

SHARES SAYS: This looks a smart addition by the company and only enhances our positive view of the stock. Keep buying the shares.

‹ Previous2021-09-02Next ›

magazine

magazine