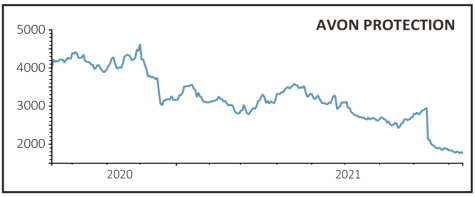

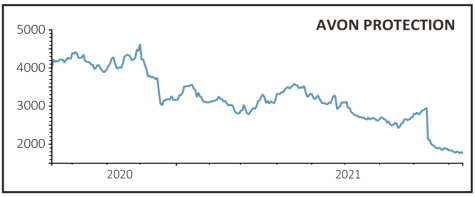

Avon Protection (AVON) £17.86

Loss to date: 33.7%

Original entry point: Buy at £26.94, 29 July 2021

Investors in defence firm Avon Protection (AVON), nursing the wounds from a 13 August profit warning, might have hoped news of a contract win on 8 September would restore some momentum to the share price.

However, the $87.6 million award from the US Army did little to arrest Avon’s recent slide. The key reason was that it merely replaced a previous contract to supply a next generation Integrated Head Protection System, which had been withdrawn in the face of a competitor protest.

For now, the market remains wary of ongoing risks facing the business, as Berenberg recently noted: ‘Any further challenges with the body armour product approval could result in further earnings downgrades, asset write-downs and longer-term revenue and reputational damage.

‘Supply chain challenges could remain problematic too, while we also await the appointment of a new chief financial officer, who could reassess current guidance.’

SHARES SAYS: We think investors will eventually be rewarded for their patience, but it will require a more significant catalyst to get the stock moving in the right direction. Sit tight for now.

‹ Previous2021-09-16Next ›

magazine

magazine