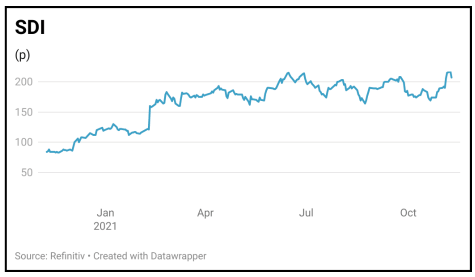

SDI (SDI:AIM) 217p

Gain to date: 23.7%

Original entry point: Buy at 174.5p, 27 May 2021

As pandemic recoveries go SDI’s (SDI:AIM) should be counted as very encouraging by investors. A 4 November half-year update revealed that the science kit maker expects ‘very strong sales and profits’ with approximately £24.7 million in revenue. That’s just £800,000 less than it did in the whole of last year, albeit a Covid capped one.

Part of this boost can be explained by a stronger-than-expected performance from Monmouth Scientific, bought last December, slightly higher Atik sales but largely from broad-based growth across its businesses.

SDI is a collection of multiple subsidiaries that design and manufacture digital imaging, sensing and control equipment used in life sciences, healthcare, astronomy, manufacturing and other technology-heavy industries.

Analysts responded to the latest update by increasing expectations by mid-single digits for the next two financial years. While it is not yet clear if first half sales strength was simply a pull forward, ‘if not, it offers scope potentially for upgrades later in the year,’ says FinnCap.

Shares previously said SDI represented a multi-year growth story with the potential to add substantial value to retail investor portfolios and that optimism remains undimmed now.

SHARES SAYS: SDI remains a great growth stock to own.

‹ Previous2021-11-11Next ›

magazine

magazine