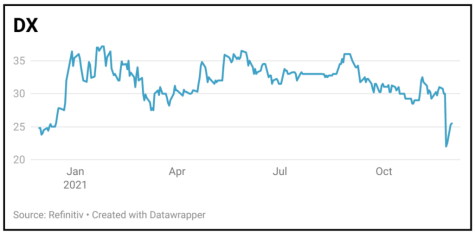

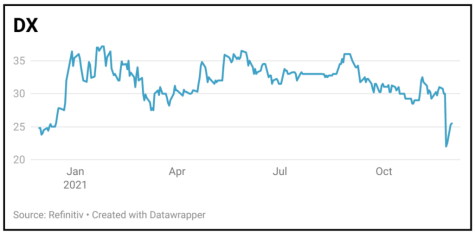

Loss to date: 17%

Like the rest of the market, we were completely blindsided by the announcement from DX (DX.:AIM) on the day of its annual general meeting last week that it couldn’t publish its annual report due to ‘a corporate governance inquiry’ raised by its audit and risk committee.

Investors headed for the hills and didn’t look back, selling the stock down as much as 40% at one point on more than 25 million shares, the biggest volume for over six months.

The firm said the inquiry related to an internal investigation begun during the financial year to the start of July, and until it was concluded the accounts couldn’t be signed off.

In all likelihood, that means the annual report won’t be ready before the start of January, at which point under AIM rules the shares will be suspended.

While we have no special insight into what has happened, we are at least comforted by the fact the firm’s operations appear to be unaffected and the outlook remains unchanged.

Meanwhile activist fund Gatemore, which owns 20.5% of the company, is asking for a seat on the board while both chairman Ronald Series and CEO Lloyd Dunn have been buying shares in a show of faith in the business.

SHARES SAYS: While we sympathise with the sellers, we would hold on for clarification.

‹ Previous2021-12-02Next ›

magazine

magazine