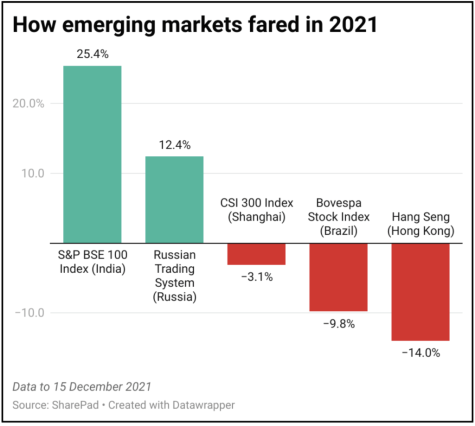

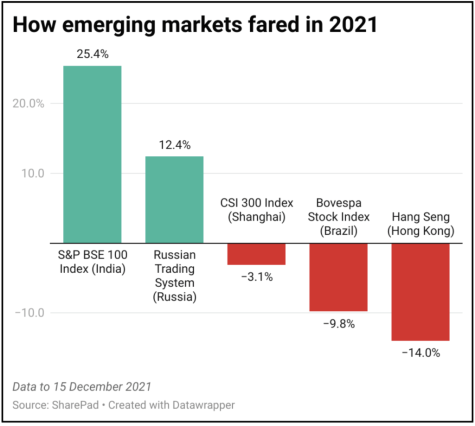

Looking at the performance of the big emerging markets in 2021 India is a clear winner, with Russia somewhere in the middle and Chinese and Brazilian stocks struggling to keep up.

The pandemic remains a key source of uncertainty as we look ahead to 2022 but there are some other key events to watch out for in developing economies in the coming 12 months.

Election results may impact the market. India is set to hold some key state elections early next year, which could have an impact on the political fortunes of incumbent prime minister Narendra Modi, even if he doesn’t face another general election until 2024.

Brazil will elect a president in October 2022. The election of incumbent Jair Bolsonaro in 2018 was initially received positively by investors given his perceived market-friendly policies but poor economic performance and a controversial approach to the Covid-19 pandemic have shaken the faith of voters and the markets.

China typically looks to provide support to its economy to maintain stability in the run-up to its five-yearly Party Congress which is a key political event taking place at the end of next year.

The country’s next five-year plan, which will be agreed at the Congress, may look to encourage the ongoing transition from export-driven growth to a more balanced economy where domestic consumption plays a larger role.

As part of the COP26 agreement struck in Glasgow in November 2021 China and some other emerging markets (and developed nations) are expected to come back with more ambitious emissions targets so expect some focus on Chinese investment in a transition away from fossil fuels.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

‹ Previous2021-12-23Next ›

magazine

magazine