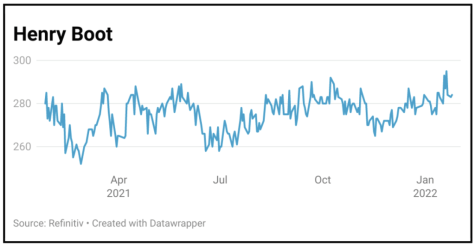

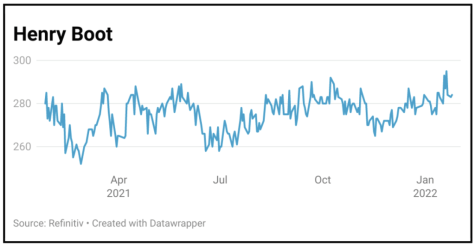

Henry Boot (BOOT) 283p

Gain to date: 0.7%

Original entry point: Buy at 281p, 30 September 2021

When construction group Henry Boot (BOOT) released its full year trading update on 18 January the shares popped to 300p in celebration, however since then markets have been clobbered.

What matters though is the fundamentals, and all three of the group’s markets – industrial and logistics, residential, and urban development – continued to see strong trading.

Demand for logistics property shows no sign of slowing, while a buoyant housing market was positive for both Henry Boot-owned Stonebridge Homes and Hallam Land Management which performed ‘materially’ ahead of expectations thanks to demand for residential sites.

Management indicated that pre-tax profits for 2021 would be well ahead of the £30 million consensus, leading analysts to raise their forecasts by 10% for last year and this year.

Moreover, with just £40 million of net debt there is plenty of headroom to employ more capital to get to chief executive Tim Roberts’ target of £60 million of profits.

SHARES SAYS: The shares are trading broadly in line with the group’s net book value, according to analysts at Numis, which given its record of double-digit returns on equity still seems cheap. Keep buying.

‹ Previous2022-01-27Next ›

magazine

magazine