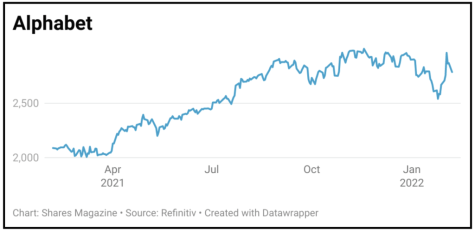

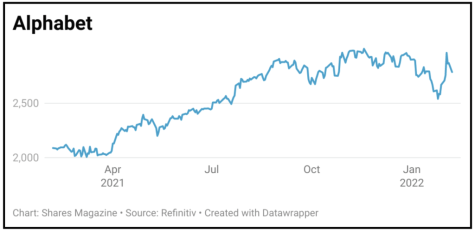

ALPHABET (C CLASS) $2,778.76

Loss to date: 2.4%

Original entry point: Buy at $2,848, 23 December 2021

For our 2022 pick to be only marginally under water speaks volumes for the online search and ads giant’s strong end to 2021 considering how unloved the global tech space has been so far in 2022. Google parent Alphabet also unveiled a 20-for-1 stock split that should make investing easier for the masses.

It means that for each single share worth the current $2,778 (roughly), investors will instead own 20 at $138.90, a much more manageable chunk of cash for those investing out of their monthly salary, for example. If the stock split gets voted through, shareholders will get their new shares on 15 July.

As for the numbers. Alphabet reported better-than-expected fourth quarter earnings and revenue, the latter growing 32% in the three months to 31 December 2021, proving again that it was able to withstand the pressures from the pandemic and inflation.

It beat estimates on both the revenue and earnings lines, posting $30.69 earnings per share versus $27.34 expected, according to Refinitiv, while revenue came in at $75.33 billion, topping the $72.17 billion forecast. YouTube advertising revenue was $8.63 billion, a little shy of estimates, offset by a modest beat from Google Cloud’s $5.54 billion.

SHARES SAYS: Alphabet’s 20-for-1 stock split will make is easier for ordinary investors to buy.

‹ Previous2022-02-10Next ›

magazine

magazine