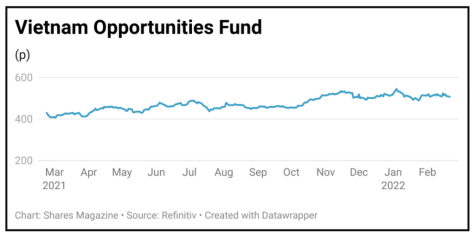

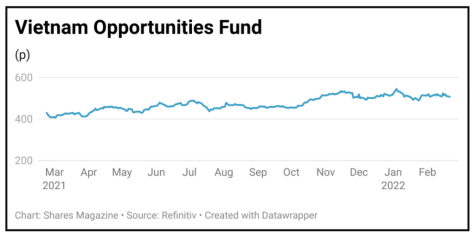

Vietnam Opportunities Fund (VOF) 512p

Gain to date: 11.3%

Original entry point: Buy at 460p, 23 September 2021

Considering A VOLATILE start for 2022 for markets in our call on the Vietnam Opportunities Fund (VOF) has turned out to

be quite a safe option.

That is largely due to the management team’s strategy of investing in attractively-priced growth companies which benefit from the strengths of the Vietnamese economy.

Most holdings are in financial, real estate, food and beverage and steel stocks, which play into the rapidly rising spending power of domestic consumers and particularly their desire for car and home ownership.

These shares holdings typically trade at below market average multiples, which has helped insulate the fund from the sell-off in risk assets.

Despite a modest correction in December, the fund’s NAV (net asset value) grew 37.2% last year with total assets approaching $1.4 billion.

The listed holdings, which make up two thirds of assets, generated a 55% return, while the valuation of the private and unlisted equity holdings – which make up 28% of assets – was last carried out at the firm’s year-end in June, meaning their current valuation is likely to be significantly higher.

SHARES SAYS: We continue to like Vietnam as a market and VOF in particular.

‹ Previous2022-02-24Next ›

magazine

magazine