Three companies we’ve highlighted as Great Ideas over the past year are in takeover situations, demonstrating we were right to flag the appeal of the shares.

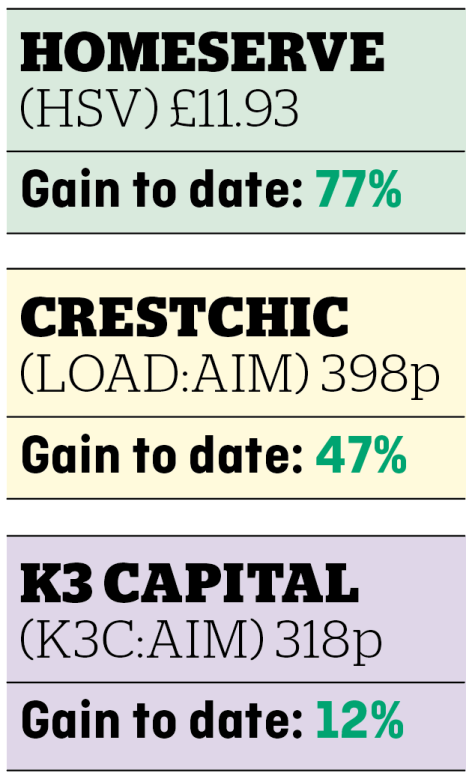

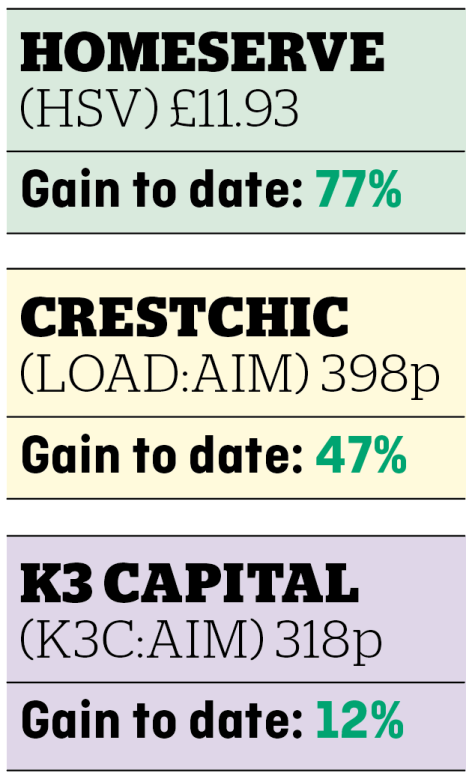

We said to buy home repair specialist Homeserve (HSV) at 675p in March, citing a ‘proven operating model and a strong balance sheet’ and promising growth prospects in the US. We highlighted Crestchic (LOAD:AIM) at 270p in October noting the transformation of the group to focus purely on load banks – in-demand kit used to test power systems. Ambitious growth plans attracted us to business services and advisory firm K3 Capital (K3C:AIM) in February.

WHAT’S HAPPENED SINCE WE SAID TO BUY?

Homeserve accepted a £12 per share offer from Canada’s Brookfield Asset Management in May but the deal is yet to close as it goes through several regulatory hurdles. Completion is now expected by early 2023 at the latest.

Crestchic and K3 Capital both reported takeover approaches in early December. The situation at Crestchic looks more advanced with emergency power outfit Aggreko agreeing a recommended cash bid of 401p – directors and institutions representing 38.5% of the share capital said they would back the deal.

The price has attracted criticism on social media. One Twitter user wrote: ‘Not happy with the #LOAD offer and surprised (major shareholder) Harwood have agreed to it. I’ll continue to hold Crestchic, at least for a bit, just in case we see a higher offer emerge.’ K3 Capital remains in talks with US private equity firm Sun Capital over a £257 million offer.

WHAT SHOULD INVESTORS DO NEXT?

Take profits on Homeserve but wait to see how it all plays out at Crestchic and K3.

‹ Previous2022-12-15Next ›

magazine

magazine