Walt Disney $108.10

Gain to date: 26%

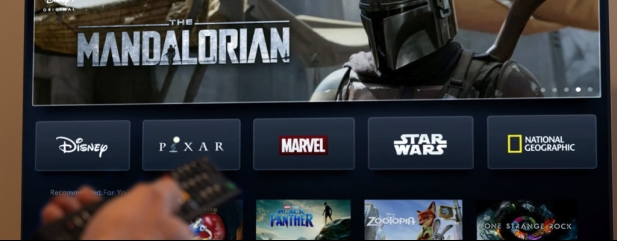

We chose Walt Disney (DIS:NYSE) last December as one of Shares’ 2023 picks of the year. We highlighted the 45% share price decline during 2022 as an ‘outstanding’ opportunity to buy into one of the world’s best loved brands.

We expected the return of Bob Iger as CEO in November 2022 to reinvigorate the creative side of Disney and give the ‘House of Mouse’ its mojo back. We also said a review of the company’s cost structure could provide a big catalyst for the shares.

WHAT HAS HAPPENED SINCE WE SAID TO BUY?

In the company’s first set of results since the return of Iger, quarterly earnings to 31 December significantly beat market expectations. Earnings per share of $0.99 was 27% ahead of analyst estimates.

Disney+ subscriptions stood at 161.8 million compared with estimates of 161.1 million.

A price hike for Disney’s streaming services was expected to cut subscriptions by more than three million, but the service proved stickier with losses of ‘only’ around 2.4 million.

The direct-to-consumer business made a loss of $1.1 billion which is lower than expected and an improvement on the $1.5 billion in the prior quarter.

The parks and experiences operation was particularly strong as the recovery from the pandemic continued with revenues growing 21% to $8.7 billion.

Looking to boost creativity and increase profitability, the company announced a restructuring of the firm into three divisions while cutting seven thousand jobs and slashing costs by $5.5 billion.

The media and streaming businesses will now operate as Disney Entertainment while the ESPN division will house the TV network and ESPN+, leaving the parks and experiences operation as the third leg of the business.

Iger said the company plans to reinstate the dividend by the end of the calendar year funded in part by the cost cutting initiatives.

WHAT SHOULD INVESTORS DO NOW?

Although the shares could go higher, a lot of the benefits from the restructuring have now been priced into the shares while the challenges faced by the streaming business remain a risk. Take profits while the going is good.

‹ Previous2023-02-16Next ›

magazine

magazine