Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

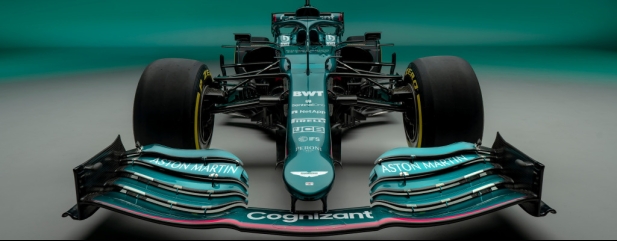

Aston Martin shares jump the gun in rush for profitable growth

Share prices often move up or down but the rally in those of Aston Martin Lagonda (AML) in recent months has left investors and analysts dumbfounded. Since early November 2022, the stock has soared 235%, a run that has added nearly £1.5 billion to the luxury car maker’s market valuation.

There’s clearly more going on than retail investors getting excited about Fernando Alonso’s podium finish at the Bahrain Grand Prix on 5 March, as had been suggested.

Analysts at investment bank Jefferies believe the stock has jumped the gun, cautioning that paying off debt and sustaining growth while funding a shift to electric will be a tough task to pull off.

‘The path to organic deleveraging is unclear with more capital likely needed to fund electrification investments,’ the analysts said. ‘Given market and execution risks we would look for more attractive entry points (for the shares).’

Jefferies has cut 2023 volume estimates for the sports car maker by 5% to just above 7,000 units, still up 9% on last year’s 6,412, citing an expected rise in debt to £900 million by the end of this year.

On 1 March, Aston Martin reported full-year revenues of £1.38 billion for 2022, a 26% rise versus 2021. That is partly down to the mix of models but also points to the pricing power the luxury brand enjoys. It can push up prices for its deep-pocketed customers and still grow sales volumes.

In the fourth quarter of 2022, Aston Martin sold 2,352 cars, a 22% year-on-year increase on 2021’s 1,928 vehicles, that helped sales surge 46% to £524 million. This is good news for the company and investors, as is confidence in its target of around 10,000 wholesale car sales volumes in time, although it did quietly drop the 2024/25 date previously attached to that ambition.

Aston Martin still hopes to hit around £2 billion of revenue and £500 million of adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) by then.

In the context of past share price performance, there are reasons to be less sceptical, if not entirely cheerful. ‘The company is at least trying to get things moving in the right direction, investing in new vehicles to help capitalise on what is still a brand with wide appeal among motorheads,’ said Russ Mould, investment director at AJ Bell.

Jefferies dubbed the results ‘a treat’, but pointed to ‘mixed details’ and is forecasting free cash flow to remain negative in 2023. Aston Martin burned through nearly £300 million of free cash in 2022. Jefferies also doesn’t see pre-tax earnings break even until 2024.

DISCLAIMER: AJ Bell owns Shares magazine. The author (Steven Frazer) and article editor (Daniel Coatsworth) owns shares in AJ Bell.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Editor's View

Feature

Great Ideas

News

- Aston Martin shares jump the gun in rush for profitable growth

- China’s new 5% growth target underwhelms as its focus shifts to boosting consumption

- Fresnillo suffers as costs surge and precious metals lose some shine

- Shaftesbury focused on income growth and cost cutting as it completes Capco merger

- ASOS shares gain 80% year-to-date on growing turnaround hopes

magazine

magazine