Emerging markets are more reliant on fossil fuels than the developed world with developing countries lagging in terms of the transition to greener forms of energy.

In research published earlier in 2023 the World Economic Forum observed: ‘By 2030, annual renewable energy investment in emerging countries needs to be multiplied by more than seven – from less than $150 billion to over $1 trillion – to put the world on track to reach net-zero emissions by 2050 and meet these countries’ energy needs.’

While this is a sobering thought, it also suggests there could be significant opportunities in emerging markets as governments and other participants look to shift the dial on renewables and clean energy. Significantly, the World Economic Forum notes avoiding one tonne of CO2 emissions in emerging markets costs around 50% as much as it does in advanced economies.

Beyond environmental considerations there could be significant benefits in terms of energy cost and energy security for the developing world if it can advance its renewable sector. Particularly for those countries which are currently significant net energy importers.

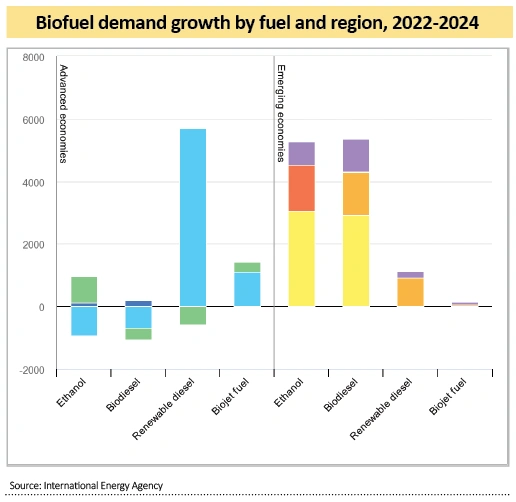

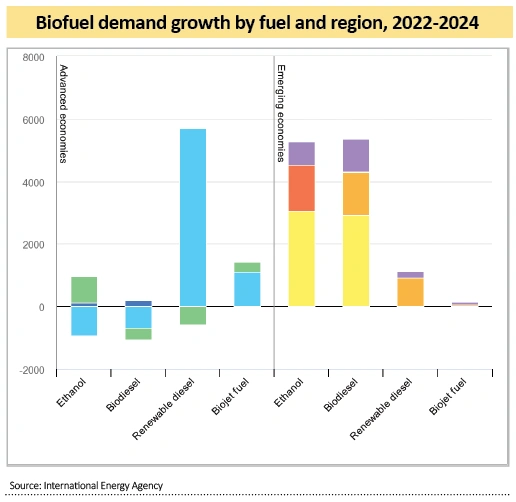

One area where emerging markets are expected to be at the forefront is biofuels. According to the IEA (International Energy Agency), domestic production of biofuels in emerging markets avoided $38 billion worth of oil import costs in 2022. In 2023 and 2024 the IEA expects two-thirds of biofuel demand growth to come from developing economies.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

‹ Previous2023-07-27Next ›

magazine

magazine