Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Why the Federal Reserve may be in a sticky situation

This column is being written just before the next meeting of the Federal Open Market Committee on 20 March and the working premise is that chair Jay Powell and his colleagues at the US Federal Reserve will leave the headline interest rate unchanged at 5.50%. If that does not turn out to the case then readers can immediately turn over the page, not least to spare the writer’s blushes.

That caveat aside, three recent datasets are moving markets in what may be very important ways. This is because they challenge the consensus narrative that the US inflation is cooling, the US economy will encounter a soft landing (at worst) and the Fed will be able to pivot to cutting interest rates, with the result that cheaper money (and a less testing benchmark in the form of returns on cash and bond yields) will propel US share prices onwards and upwards.

This test of the consensus comes at an interesting time, since the Dow Jones, S&P 500 and NASDAQ all trade at all-time highs. Also bear in mind that consensus view in 2022 was that a recession was coming – and that proved to be wrong. The consensus view in 2023 was that inflation would cool and rate cuts would come quickly – and that proved to be wrong, as markets are still waiting for the first move from the Fed (and the Bank of England and the European Central Bank, for that matter).

The markets’ misjudgement of 2022 lay the groundwork for a big rally in global equities in 2023 and their inaccurate analysis of 2023 did no damage either, as the Germany’s DAX, France’s CAC-40, Japan’s Nikkei-225 and Australia’s ASX-200 all barrelled to new peaks, just like America’s headline indices. But at the very least investors might like to consider the possible implications of a rather unfortunate hat-trick of poor forecasts in 2024.

Data crunch

The three datasets that probed the cosy consensus of cooler inflation, a shallow slowdown and lower rates were as follows:

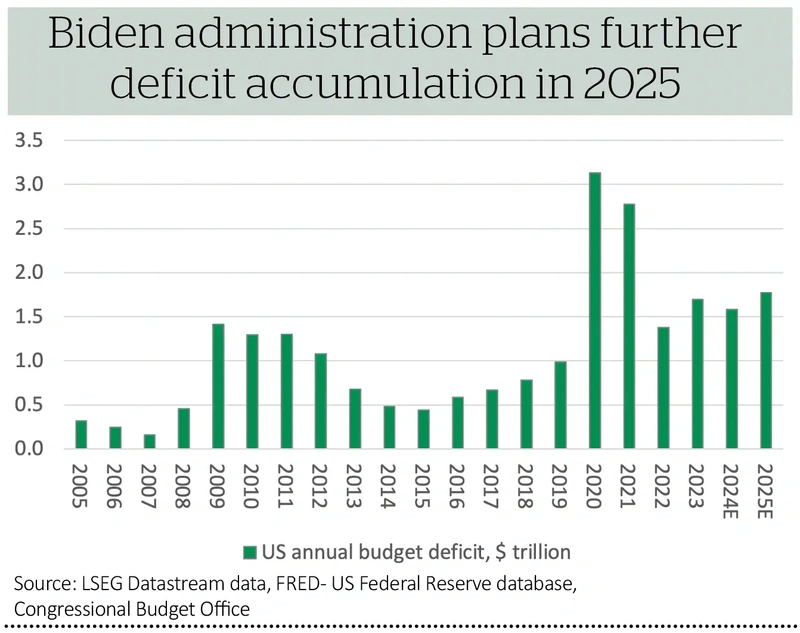

- First, the Biden administration released its planned Budget for 2025. Despite a slew of proposed tax increases to provide additional funding, including a hike in corporation tax to 28% from 21%, the $7.3 trillion spending plan still leaves a $1.8 trillion annual deficit, the third highest ever.

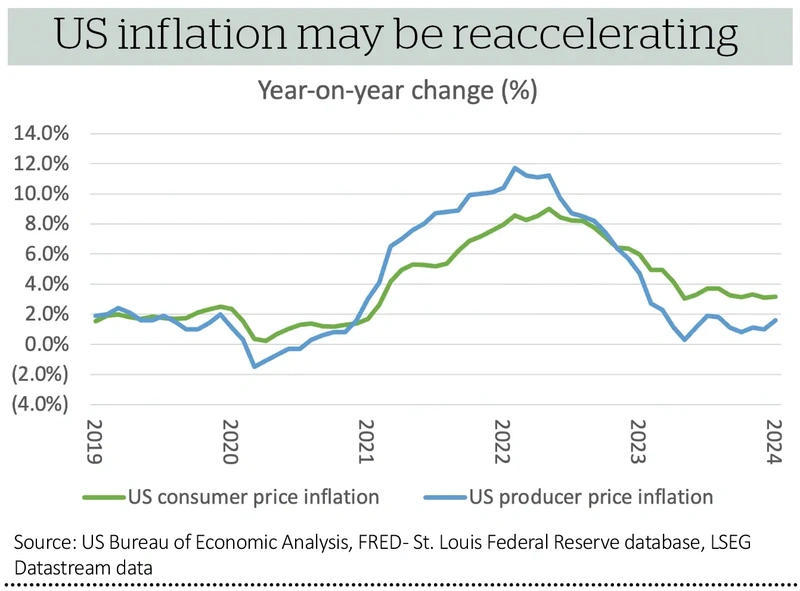

- Second, the US inflation, as measured by the consumer price index, reaccelerated to 3.2% year-on-year.

- Finally, US factory gate, or producer price, inflation also sped up, to 1.6% year-on-year. This figure can be seen as an indication of what is coming down the pipe toward consumers in time so while the lowly headline number is welcome, the increased pace of change is not.

Bond market blitz

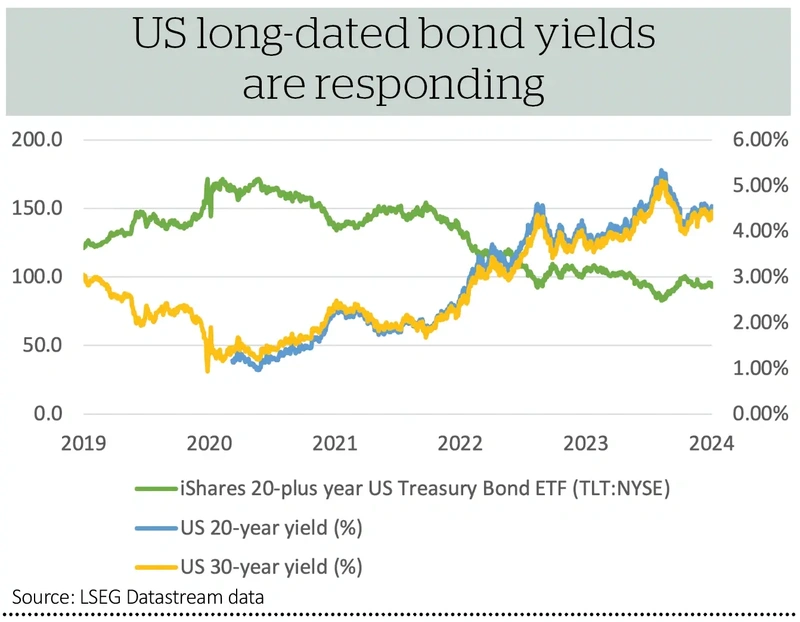

Bond markets are paying attention. The iShares 20-year Plus Treasury Bond ETF is down by nearly 8% from its December high, as long-dated US treasury yields go higher once more, in a rout that is already wiping out two years-worth of coupons at a stroke.

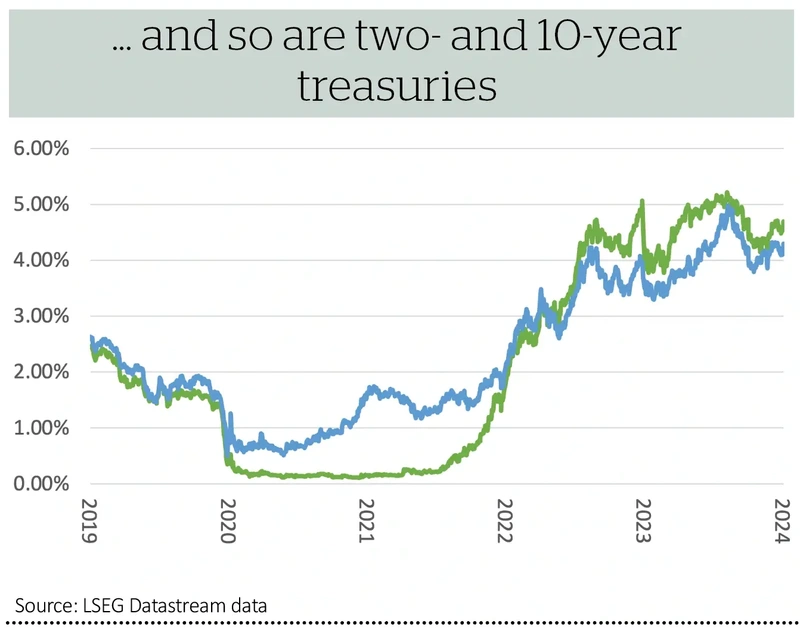

The yields on two-year and 10-year US treasury bonds are creeping higher again (and their prices sliding lower. This is in response to both the sticky inflation numbers but also, presumably, the prospect of increased bond issuance by the US government should president Biden win the election in November and get to implement his planned budget (and even if he does not prevail, the alternative, Donald Trump, is hardly known for being spendthrift).

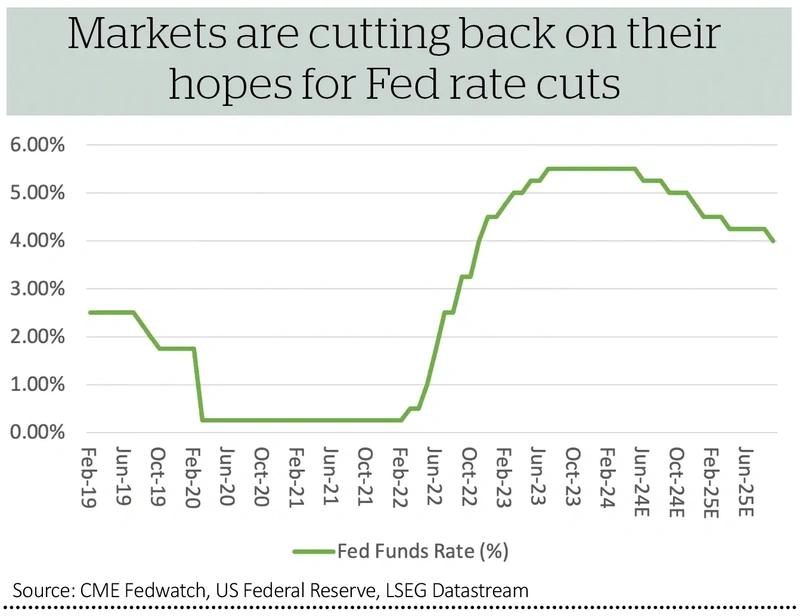

Higher bond yields reflect a recalibration of expectations for interest rate cuts, for the second year in a row. At the start of 2024, the CME Fedwatch data service suggested markets were looking for six, one-quarter point rate cuts from the US Federal Reserve this year, with the first coming in March. Now consensus is for three cuts, starting in June, with the sixth cut of the lowering cycle only coming in September 2025.

This is not guaranteed to derail the equity bull market, not least because economists were off beam in 2022 and 2023 and it mattered not a jot. But just as weight stops trains, higher rates tend to slow stocks down in the end, especially long-duration sectors such as technology and biotechnology, which is exactly where investor optimism is most prevalent at the moment.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Exchange-Traded Funds

Feature

- Understand whether Super Micro Computer is an investment flop or technology great

- Do markets actually care who wins the US election in November?

- Construct an ISA portfolio: Put the building blocks in place for investment success

- Fear of missing out has supplanted fears of a market sell-off

- Find out how London Tunnels plans to create one of the biggest tourist attractions in the capital

Great Ideas

Money Matters

News

- Springfield Properties hits new highs as confidence recovers

- Focusrite shares nosedive after company warns on sales and earnings

- Scottish Mortgage tackles NAV discount with £1 billion buyback while Witan invites new managers

- Nvidia unveils new ‘superchip’ at its first conference for four years

- Could litigation headaches lead to a breakup of Reckitt Benckiser?

magazine

magazine